11 Cele Mai Bune Portofele De Calatorie Pentru Barbati Pentru A Va Pastra Lucrurile In Siguranta Si Elegant

Binary Options vs Pocket Option Anfänger . Options, if you are new to trading then you may be slightly confused.

Why can't I withdraw from IQ Option? You can only withdraw to your bank card the total amount deposited from your bank card within the last 90 days. We send you the money within the same 3 days, but your bank needs some more time to complete the transaction (to be more precise, the cancellation of your payments to us).

Can you transfer money from one Pocket Option account to another? Yes, via the "deposit" button. You then have the choice between depositing money from your main account or another pocket of yours.

What is a binary option and how is it different from a traditional vanilla option?

This is indeed an important question as one cannot really be expected to make money trading either without having a theoretical understanding of how they work and what characteristics they share.

You cannot simply jump into binary option trading without knowing where it came from. We will go through the differences and similarities between binary options and traditional options in depth.

Binary Options vs. OptionsIntroduction 11 Cele Mai Bune Portofele De Calatorie Pentru Barbati Pentru A Va Pastra Lucrurile In Siguranta Si Elegant

An option is a financial instrument that is a derivative on another asset. This means that is derives it’s value from the value of some underlying asset. An option gives the holder the right but not the obligation to buy or sell the underlying asset at some predetermined time in the future. This is why they differ from other derivative instruments such as Futures. The holder of the option does not have to execute on the underlying contract if it is not profitable for him to do so.

Options can be written on a range of financial assets from Equity, to commodities, Forex, interest rates and even bonds and credit ratings. Options contracts are by no means a new phenomenon in the financial world. They have existed for hundreds of years and first started being offered in ancient Greece as a way for farmers to hedge their olive crops. Since then, they have been used in commodity circles for a number of years.

People then started to trade options on equities (stock options) and interest rates (Swaptions). These then evolved into an asset class in their own right which culminated with them officially being traded on the Chicago Mercantile Exchange in 1973. This created a large market for them with full liquidity similar to how traditional stock markets would operate.

Some Option Fundamentals

Option theory can be quite a complicated discipline but there are a few fundamental factors that one needs to know about in order to trade them. Some of these are more relevant for quantitative traders than others but it helps to have an overview of them all.

Current and Strike Price

Time To Expiry

CALL or PUT

Option “Moneyness”

Price Volatility

Payoff

Premium

Option Example

We will take a look at a graphical example of a call option payoff in order to help cement your understanding of how an option would work.

In the image on the right we have a CALL option. The price of the asset is plotted on the x axis and the Profit / Loss is plotted on the Y axis.

We can see that the strike price (K) of the option is at 110. Looking at the payoff structure, one can see why options have an asymmetric payoff. The maximum loss that the trader can lose is the option premium when the option is out of the money.

On the upside though, the potential profits from holding the option are unlimited. This is the reason why options can be such a profitable derivative instrument.

Of course, this is rather simplistic as the option price does vary according to the time to expiry and the volatility in the underlying asset.

What is a Binary Option?

Binary options share all of the same underlying factors as traditional vanilla options. When pricing binary options, the same inputs are used to determine its value. The only way in which they differ is their pay-out structure on expiry.

On expiry of a binary option, the pay-out of the option is only one of two outcomes. That is either 0 or 1 (100). This is why it is sometimes termed “binary” or “digital”. These are the basics of binary options and how their payoff is determined. This is in contrast to the vanilla option where the payoff is indeed variable on the upside.

We have included an image on the right that is the pay-out of a binary option on the expiry of that option. Unlike with the traditional options, the payoff is capped at a certain amount. This means that no matter how high the asset price goes, this will be what the trader will gain.

Binary Options have been traded Over the Counter (OTC) by large investment banks and hedge funds for a number of years. They were also considered quite difficult assets to trade due to the nature of their payoff. The large market makers who were trading Binary Options with millions in notional found it hard to hedge the binary outcome.

What is a Binary Option?Retail Binary Options Market

It was not until about 2008 that Binary Options started to gain a large degree of interest from the retail market. Average investors who previously had traded Forex and CFDs now had the opportunity to trade a different type of instrument. They did not need to know about the underlying option theory in order to take a “bet” on the direction of the asset.

Binary Options trading then took on a different form and could allow traders to enter a trade with expiry times of as little at 1 minute which was unheard of in the option industry. Binary Option trades were also simplified down to the point at which the trader could merely decide whether the option was going to go up or down in the next few minutes.

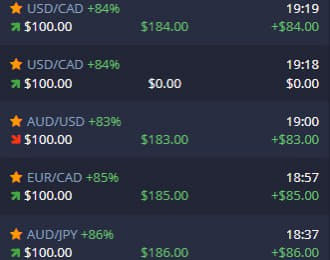

Payoff was also determined as a percentage “win” on the trade. Hence, if the trade ended up in the money then the trade would get a payoff that ranged from 50%-80% of the amount that was staked on the trade. Retail binary options also operated as a European option variant where the trader had to wait until expiry. This is in contrast to most traditional vanilla options where execution can be done prior to expiry.

Indeed, there were a number of traders who merely traded binary options on a hunch and this was more gambling than investing. Binary Options trading morphed from a complicated derivative instrument that investment banks struggled to hedge into a quick and easy way for retail traders to enter the market.

Benefits of a Binary Option

Even though most traders sometimes treat binary options as a mere bet on the movement of the underlying instrument, they do enjoy this form of trading. Unlike traditional option trading, the trader does not have to monitor the underlying factors that impact on the price of the option such as those we mentioned above.

Benefits of a Binary OptionThey don’t have to necessarily study the dynamics of option pricing in order to do relatively well trading binary options. They merely have to have a view on where they think the asset is likely to go based on a number of different trading signals and indicators.

Moreover, traditional option trading is not easily available to most retail traders. This is because there are usually quite large minimum account requirements to maintain a vanilla option account. However, Binary options brokers have much lower account requirements that start as low as $10 for some.

If you are a relatively new trader who would merely like to take a view on some asset over a very short period of time then you may be better suited to trading a binary option. However, if you have more funds available and would like to learn about trading options fundamentals then traditional vanilla options could be for you.