15 Dintre Cele Mai Bune Salopete Pentru Barbati Pentru A Le Strecura In Tot 2022

To avoid fraud in binary options trading, choose a trustworthy broker . These brokers can help minimize your losses and provide a measure of security for your funds . Some traders turn to smart contract-based binary options transactions to fortify https://1investing.in/ their deals using blockchain technology . Binary.com is the one of best binary options brokers in the market with a minimum deposit of only $5 Pocket Option Ali Khan . This is the lowest minimum deposit we could find on one of our most recommended trading companies.

Can US traders use Pocket Option? Pocket Option is a binary options broker providing access to over 100 different assets ranging from forex pairs to company shares and cryptocurrencies. The brokerage offers regulated services for clients in over 95 available countries and regions, including the UK, the United States (USA), India and Europe.

How much to make $500 a month in dividends? That usually comes in quarterly, semi-annual or annual payments. Shares of public companies that split profits with shareholders by paying cash dividends yield between 2% and 6% a year. With that in mind, putting $250,000 into low-yielding dividend stocks or $83,333 into high-yielding shares will get your $500 a month.

Besides the aforementioned potential payout, the big difference between trading binary options on an exchange or over-the-counter brokers is regulation. Unlike most other brokers, Binary.com provides you with multiple trading platforms to choose from, ranging between MT5 to Binary Bot to SmartTrader. This allows beginners and experts to take advantage of their network with the trading platform they prefer based on their experience level or ease-of-use.

Nadex is one of the most popular binary options trading platforms . One of the big reasons for this is that it is regulated by the Commodity Futures Trading Commission . Another one is that it makes trading very simple and easy to understand Pocket Option Investing . This is thanks to a simplified trading format and intuitive platform.Introduction 15 Dintre Cele Mai Bune Salopete Pentru Barbati Pentru A Le Strecura In Tot 2022

Their market options are quite diverse, with multiple different digital options available for trading. They’re also fairly accessible, with low minimum investments of one dollar and maximum returns at about 100% profit on your stake. Our comprehensive IQ Option review goes in more detail on how these traits may benefit you.

Safetradebinaryoptions.com is not responsible for any loss of money and possible risks connected with options trading. This broker gives an accessible test trading facility for those learning to trade. This facility has $1,000 of virtual money that you can refill at any time. These tools make for winning trades and quality investments. Cypriot holds a certificate authorized by the Center for Regulation of Financial Markets Relation . Quotex offers advanced trading indicators and plenty of trading assets.

Popular Binary Options Brokers of 2022: Which One Is The Best For Trading?

You should also know how realistic the demo account is when compared to a live account. Demo accounts may not prepare you for the fast-paced, unpredictable nature of the real markets. If you sign up at IQ Option or Binary.com or any other platforms we recommend, you can not only trade, but also learn more about trading. Countries that have legalized trading of binary options are New Zealand, United States, United Kingdom, Japan, Malta and Cyprus. Signing up at multiple brokers, therefore, is one of the best trading strategies a serious trader can use. It’s preferable to choose an online broker whom customer care support responds fast and is available for 24 hours a day in a seven-day week.

- Binary options platforms have different benefits for traders.

- Additionally, new traders will value Pocket Option’s thorough education section, which includes lessons and recommendations on binary trading tactics.

- You could deposit through Bitcoin or use e-payments like Perfect Money, Yandex, and many more.

- Nadex is one of the most popular binary options trading platforms.

- The demo account offered is among the best in the industry.

Clients can access regulated services in over 95 countries and regions, including the United Kingdom, the United States, Europe, and India. It is reasonably easy to use and provides smooth customer service when needed. This popular binary options tool offers a free demo account to help you get started. There is also the premium VIP account, which is available to clients who deposit significant amounts .

A broker operating an exchange does not mind who wins and who loses. The broker will make their commission on the trade regardless of the outcome. Regulation is there to protect traders, to ensure their money is correctly held and to give them a path to take in the event of a dispute. It should therefore be an important consideration when choosing a trading partner. There is also the issue of payouts, trading costs, bonuses, and trading conditions.

Binary option

The best way to know if a broker is legit is to ensure it’s regulated. Regulatory oversight ensures that your money goes into the right hands, decreasing the risk of fraud. In general, brokers that offer both Binary Options and CFDs have a more feature-loaded platform. Concluding definitively that a certain brokerage is the best one you can sign up with is not easy.

We base our comparison on criteria such as maximum returns, regulations, bonus offers, minimum deposits, and more. Picking the best binary trading broker is an important step for many people based on personal needs. You will learn how to start trading binary options, legalities, tips, and strategies. Nadex is the only well-regulated binary options broker, and it has a minimum deposit requirement of $250. Though many offshore licensed binary options brokers are allowing much less initial deposits, we highly recommend traders not to open accounts with such entities.

Demo Accounts

That margin is significant mainly because both sides are hedged. The broker does have protection in case he doesn’t get enough margin. The tighter spread in buy and sell prices makes your trading cheaper. The best scenario is this – you get a secure trading platform, numerous bonuses, and a 90% payout rate. You also want to be sure your broker has good flexibility for trade expirations. A broker lets you use a trading platform that belongs to him.

Also, not every trading broker will offer you the same initial funding amount. Maybe one wants you to find information about regulations or reputable binary options trading broker; the other wants you to do fundamental negative roi research. To trade these financial options, they must be traded on a regulated US Exchange. Binary Options can be offered on registered trading platforms or on DCMs – supervised by the CFCT or SEC.

Usually, a binary options trading platform offers more than 30 different indicators. Sometimes it is hard to find a good working strategy with them. In addition, they give you some advanced knowledge and information to rule the markets. Most brokers offer you a better education if your deposit is higher . The broker allows binary options trading on a variety of assets.

eToro Key Features

However, comparing payouts between brokers is more complicated than it seems. A higher minimum trade size may not be a dealbreaker to some traders, but it can be a dealbreaker to many others. Brokers typically have a minimum trade size ranging between $1 and $50. Ideally, you want the minimum trade size to be $25 or lower.

RaceOption is a trading platform that is perfect for beginners. 1 hour withdrawals, % deposit bonuses, and copy trading are a few of the features we love most. Below you will find our rankings of the top binary options trading brokers of 2022. For instance, you can take a call binary option that pays off if an asset price is higher than the strike price at the expiry date.

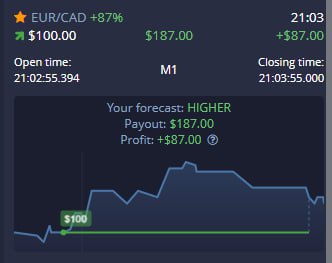

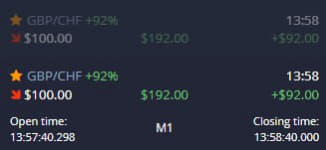

For example, if the payout was 70%, the binary broker credits the trader’s account with $70. Both cryptocurrencies and CFDs are complex instruments and come with a high risk of losing money. The binary options or options trading structure differs much from other trading modes. However, to succeed and become an expert, you need to know how the market moves.

Many of these unregulated binary options brokers have questionable ethics and use false advertising and promotions to lure new binary traders to become their clients. These unregulated binary options brokers do not report to any regulatory body and hence do not need to conform to a specific set of rules. When choosing a binary options trading broker, one of the most important considerations should be the trading platforms offered by the broker. Smart Trader, Meta Trader 5, Binary Web Trader, and Binary Bots are some of the most popular trading platforms that are offered by most firms. A binary options broker simplifies the process of buying and selling binary options. These platforms are easy to use, offer bonuses and significant rewards for account creation, and help new traders learn more about alternative trading processes before they start.