Cel Mai Bun Deodorant Pentru Barbatii Care Vor Sa Miroseasca Bine

Binary options are one of the simplest investment tools available Pocket Option Arbitrage . But be warned, they are also among the riskiest as well.

Does pocket money really work? The Pocket Money app is indeed real and not fake . It is a legitimate mobile application that helps users track their expenses , set budgets , and manage their finances . The app has been featured in various reputable publications and has received positive reviews from users .

Do you need 25k to day trade options? The $25k requirement for day trading is a rule set by FINRA. It's designed to protect investors from the risks of day trading. By requiring a minimum equity of $25k, FINRA ensures that investors have enough capital to absorb potential losses. But remember, even with $25k, day trading is still a high-risk activity.

Introduction Cel Mai Bun Deodorant Pentru Barbatii Care Vor Sa Miroseasca Bine

Binary options are a lot simpler to understand than any other investment tool. One reason for this is their simplicity, as well as the possibility of obtaining high rewards in a very short time period. Another reason is it’s possible to open a trading account with very small amounts of capital. These factors have made binary options increasingly popular in recent years.

Unfortunately, many inexperienced traders do not realize that these characteristics also make binary options a very dangerous investment instrument which may, over time, swallow a considerable portion of their life savings Pocket Option Bollinger . To make things worse, binary options are very prone to fraudulent activity.These days the internet is full of various websites describing and suggesting that this sector is the best way to invest money. However, traders must ask themselves if these sources are trustworthy when they very often contain generously sponsored links to number of different brokers. I’ll let you form your own opinion on that.

In any case, we are not saying that everything associated with binary options is wrong, and certainly there are individuals who are actually very successful with this method. So let's look at the binary options without wearing rose tinted glasses.

Disclaimer

Because binary options represent an extremely risky type of investment, with many of the typical elements associated with gambling, we feel the need to draw attention to parts of our disclaimer:

Our content is designed exclusively for educational purposes and content must be used as informational source only for your own analysis and research. No part of content must be understood as a recommendation to enter into any investment or enter into any arrangements between you and any third party. Accordingly, we will not be liable in respect of any damage, expense or other loss you may suffer arising out of such information. All final decisions are taken at your sole risk.

What is a 'Binary option'?

Binary options are a high risk investment tool with a predetermined fixed risk, reward and time frame for each trade. The principle of trading binary options is based on the prediction of whether the asset is higher or lower – simply a ‘yes’ or ‘no’ option – than the purchase price. It stands for ‘having two options’.

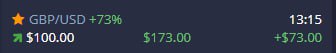

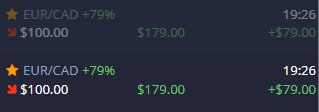

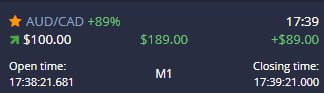

The reward and risk for trade are always known before making a trade. The reward is indicated as a percentage based on your investment amount and generally it ranges between 60% and 98% of your investment. Note, the risk is always 100% of the invested amount. If the trade is successful then the amount you invested is always paid back in full (plus the return indicated in advance). Or if it is unsuccessful then nothing is paid out and the investment is fully lost.

Binary options can go by many other names. They are also called ‘all-or-nothing options’ or on forex/interest rate markets are also known as ‘digital options’. On the American Stock Exchange they are called fixed-return options (FROs).

Basic Terminology

Unlike other investment tools, binary options have a very small set of expressions, but this set is very commonly used across brokers or on websites related to binary options.

The most popular expressions and terms are:

| Term | Description |

|---|---|

| Call (option/position) | This is the opposite of a Put option. This term is used in a basic binary option as a definition for an option (or position) where a trader predicts an increase in the value at the expiration against the strike price. |

| Put (option/position) | This is the opposite of a Call option. This term is used in a basic binary option as a definition for an option (or position) where a trader predicts a decrease in the value at the expiration against the strike price. |

| Underlying asset | An ‘underlying asset’ is a term that originates in derivatives trading. In derivatives trading the underlying asset is the financial instrument on which a derivative’s price is based (this can be a commodity, currency, stock, futures or index). But in binary options the trader never owns any assets, they simply speculate on the movement of an asset - so the underlying asset here is simply based on the price of a trade or option. |

| Pip | This is an acronym for ‘Percentage In Point’. The value of the underlying asset could be represented by up to five decimal places and the pip is represented as the lowest value to the right of the decimal. Movement of the value of the underlying asset - even of just one PIP - decides on whether a trade is successful or not. |

| Current price | The current price indicates the underlying asset's real time rates and prices. |

| Strike price | The strike price is the price of an underlying asset at the time of purchase. |

| Closing price | The closing price indicates the underlying asset's rate at expiry time. The closing price is compared to the strike price or other condition to determine whether an option is successful or not for the holder/trader. |

| In the money | An option is referred to as ‘In The Money’ when it was successful at expiry time from the perspective of the holder of option. The opposite of ‘In the money’ is ‘Out the money’. |

| Out the money | Out the money is the definition for a failed option (position) at expiry time. Full investment is lost. The opposite of this situation is term called ‘In the money’. |

| At the Money | This is definition for a very rare situation in binary options where the option at expiry time doesn't qualify for designation In the money nor Out the money. This is neither a win or a loss and your investment will be credited back to your account. |

| The expiration time | The expiration time, also known as ‘maturity time’, is an exact date and time of when an option ends. This date and time is always known before the contract end. After that, the option becomes null and voided. |

A small notice regarding Call and Put options. These terms are used only in basic types of binary options – those that we call High/Low options where the investor predicts the increase or the decrease of an underlying asset. In layman's terms the Call means answer YES (asset will increase) and Put represents answer NO (asset will not increase, asset will decrease). In other types of binary options the answer YES (Call) will be labelled differently, such as: Touch, In, Above, Up etc. And for the answer NO (Put) the term used is: No touch. Out, Below, Down etc.

What assets can be traded as binary options?

A big advantage of binary options is the fact that there is a wide range of assets that can be traded. For new traders this range is quite sufficient. But the fact is that this is just a fraction of what can really be traded on the market.

Similar to other investments, the assets available to trade as binary options will vary, according to which broker you decide to go with. The four most popular classes of assets used are:

Stocks – This is the most extensive class of asset in binary option to trade and covers approximately 50 of the biggest and most interesting companies traded on the stock exchange, such as Google, Facebook, Amazon, SONY, Vodafone, HSBC, Apple, Microsoft, Coca-Cola, MasterCard or Yahoo, to name just a few.

FOREX – The second most extensive class of assets to trade in binary options is represented by currencies. It covers all the top currencies pairs composed of major currencies such as USD, EUR, GBP, JPY, CAD, CHF and AUD and several more.

Indices – This class of asset lists the top indices in the world such as NASDAQ, DAX, DOW, FTSE, S&P etc. Perhaps unknown to beginners, it also covers exotic indices such as Bombay 30, Kuwait index, Tel Aviv 25 Index (TA-25) or Tadawul.

Commodities – This asset class in binary options has the smallest number of assets to trade. Usually it covers top commodities such as gold, silver, oil, coffee, platinum, sugar, corn, copper and a few others.

Types of binary options

Brokers offer to trade a wide spectrum of binary options. The different types of binary options offer different returns (from 50% to over 1,000% per single trade) at different levels of risk. Each one of us has a different tolerance of risk, a different strategy approach and each of us is suited to different types of investment. Over the last decade there has been a large increase in new type of binary options. These days you can trade following types:

- 1) High/Low options

- 2) Touch options

- 3) Boundary option (also known as Range options)

- 4) Spread option

- 5) Pairs options

- 6) Ladder options

- 7) Option Builder (maybe this one should be rather categorised as a feature from previous types and it is offered just by a few brokers)

To complicate things a little bit more, we must not forget that the types of binary options can be further subdivided according to expiration time. Binary options could be executed for a very short term which can be as short as just 60 or 30 seconds or even as long as one month. Some brokers present the following as other types of binary options - but in fact they are just derived from the previous types (especially from the High/Low option type).

- 1) 60 seconds binary option

- 2) Short term options

- 3) Long term options

You can find more information about types of binary options in next article that contains also a practical examples for better explanation.

Advantages

When searching for information regarding binary options it often appears to be a one-way street of success. Everywhere you are overloaded by tons of advantages as to why binary options are the right way to trade. However, you need to consider this investment tool as highly risky and see all these widely publicised advantages on many websites on the internet as clearly as possible.

As well as with the product of other financial markets, binary options trading also has a number of significant benefits. Here are the most significant of them:

- 1) No fees

- 2) TAX free (for UK traders)

- 3) Free demo accounts

- 4) Trade anywhere and anytime

- 5) Always predetermined risk and reward

- 6) 100% online trading

If you have studied binary options from other sources, you will probably notice a few points from the list of advantages missing. Very often a number of different sources mention major benefits such as: easy to understand and do; low investment amount; short-term trading; no liquidity concerns; higher returns of investments; variety types of assets that can be traded etc. Yes, all of these appear to be benefits at first glance, but as we will later demonstrate, these benefits are not as clear cut as they appear. We will discuss these points in more detail in the following article Advantages and disadvantages of binary option you should know about.

Disadvantages

Before you start any investment you should always consider the advantages and disadvantages. We list here six criterion which we evaluate as the most fundamental problems to consider with binary options:

- 1) Trading against the house

- 2) Prone to fraud

- 3) Losses are always higher then rewards

- 4) Unregulated brokers

- 5) Starting bonuses (linked to numerous terms and conditions)

- 6) No stop-loss order

The subject of advantages and disadvantages with binary options is more complex than you would think. And, unfortunately, there is much misunderstanding in this area and, in many cases, a deliberate misrepresentation of the truth. For a better understanding you should read the following article: Advantages and disadvantages of binary option you should know about where you can also find a detailed explanation of individual points that are mentioned in this list.

The bottom line

It’s very difficult to give a short, simple answer to what the value or wisdom of investing with binary options is. The issue is far more complicated than it initially appears.

Therefore we’ve decided to create a small series of articles covering all the important aspects of binary options, such as regulation issues; rewards and losses; comparison to other investments tools; types of binary options; frauds; how to protect your money and many more.

We hope that this will help you make the decision that is right for you.