Cum Sa Coordonati Pieile

Binary options are an online wager disguised as an investment . It’s an all-or-nothing “bet” as to whether an asset’s value will increase or decrease over a short, fixed period of time — similar to online gambling . In reality, most of these websites are fraudulent . In gambling terms, “the house always wins” and, more importantly, you lose Pocket Option Full Course . Not only are binary options a bad idea, offering or selling binary options to an individual is banned in Canada.

How much time does it take to withdraw money from IQ Option? Withdrawal requests are processed within 3 business days. If you withdraw funds to a bank card, the payment system and your bank will require additional time to process this transaction. Conditions may vary depending on your location. Please get in touch with Support for precise instruction.

Do people really make money on IQ Option? You cannot profit from the trades you make on a practice account. On a practice account, you receive virtual funds and make virtual trades. It is designed for training purposes only. To trade with real money, you need to deposit funds into a real account.

Introduction Cum Sa Coordonati Pieile

Whether you’re approached online or by someone you know, if it sounds too good to be true, it probably is.

Online

The Internet provides scam artists with an easy and extremely compelling way to get in front of their targets . There are numerous online binary options trading platforms that target investors through enticing online advertising Pocket Option Banane Ka Tarika . Investors will click through to a sophisticated-looking website where they can easily open an account and start trading with as little as $250 . These websites promote their trading as a simple way to make easy money with returns as high as 80 per cent.

The Internet provides scam artists with an easy and extremely compelling way to get in front of their targets . There are numerous online binary options trading platforms that target investors through enticing online advertising Pocket Option Banane Ka Tarika . Investors will click through to a sophisticated-looking website where they can easily open an account and start trading with as little as $250 . These websites promote their trading as a simple way to make easy money with returns as high as 80 per cent.

Someone you know

A friend or an acquaintance may tell you that binary options trading is on easy way to make money. No matter how much you trust that person, it’s important to remember to take the time to do independent research before you invest.

Cold calls

You receive a call from a stranger about an amazing investment opportunity involving binary options. This caller may be calling from a makeshift office (boiler room), where they “cold call” investors about an investment opportunity that sounds probable. These cold callers may falsify information, try to pressure you to invest or attempt to defraud you.

Remember

When you first start trading binary options, it may look like your trading account has hit the jackpot. However, these funds won’t be transferred to your bank account and when you try to withdraw the funds, the company may say you have had a bad day and lost your money or will not return your calls.

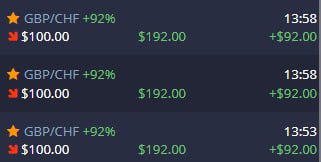

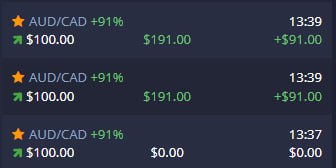

Online advertisements promoting binary options platforms may be similar to one of the ads below.

Remember, if it sounds too good to be true, it is.

A video overview

While binary options may seem like a simple way to make money, the only simple thing is this advice: stay far, far away. Hit play and watch our video overview for more information about the dangers of binary options.

Binary options red flags

Think a website is selling binary options? Even though the site may look very professional and legitimate, it may be a scam. Pay close attention and be on the lookout for these red flags:

- The company/person is not registered with the ASC or another Canadian regulator. You can check if they are registered on our Check Registration page.

- The company description is vague with no information about the management team.

- Besides its website, there is no searchable information on the company.

- There are grammar and spelling mistakes.

- The contact information is not accurate. For example, the company may list offices in New York, but when you do a search or try to call, the company is not found.

- The company is located overseas.

Do not become a statistic. Simply put, don’t invest in binary options trading.

Watch out for recovery room scams

Con artists prey on desperation and anxiety.

If you become a victim of a binary options scam, you may be contacted by another scam artist who says they can recover the money you lost. They will tell you that you lust have to pay taxes or a fee to recover your money. This recovery room scheme is another scam (also known as a boiler room scheme) and, once again, you will have lost your money. Scam artists sell the personal information of victims so they can be targeted again by a new fraudster.

Take action

- Contact the ASC – we’re here to help: [email protected] or 1-877-355-4488.

- Tell a close friend, family member, or someone you trust – this should not be kept a secret.

- Cancel your credit cards and close related financial accounts that may be at risk.

- If you provided the company with your passport information, contact the Canadian government.

Think you've been scammed?

Blog | Romance Scams: Protect yourself from online investment fraud

Read the BlogASC announcements

Read thelastest news release

Meet us in the community

View upcoming eventsRecent Posts

Find any page or article on CheckFirst as well as news releases, investor alerts, enforcement hearings, decisions and orders from the Alberta Securities Commission website.

The ASC is committed to fostering meaningful engagement with Indigenous Peoples to support and facilitate participation in Alberta’s capital markets, enhance investor knowledge, and protect investors from improper, misleading or fraudulent practices.

The Alberta Securities Commission is headquartered in the traditional territory of the Siksika, Kainai, and Piikani Nations of the Blackfoot Confederacy; the Tsuut’ina Nation, the Bearspaw, Chiniki, and Wesley Nations of the Stoney Nakota Nation; and the home of Métis Nation of Alberta Region 3.

[email protected]

Suite 600, 250 – 5 Street S.W.

Calgary, Alberta, T2P 0R4

Copyright © Alberta Securities Commission 2024

- Copyright & Disclaimer

- Privacy Statement