7 Style Lessons We 8217 Ve Learned From The 2015 16 Football Season 1.jpg

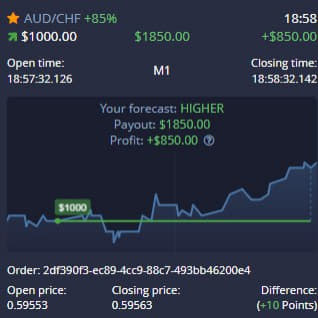

Binary options trading, with its promise of quick profits and simplicity, has attracted traders from all walks of life Pocket Option Official . However, beneath the surface of charts and numbers lies a complex psychological landscape that greatly influences traders’ decisions and outcomes.

Which is better, quotex or Pocket Option? We have rated Quotex (87%) higher than Pocket Option (84%), but the overall rating can't be the only determining factor.

What is the 11am rule in trading? What Is the 11am Rule in Trading? If a trending security makes a new high of day between 11:15-11:30 am EST, there's a 75% probability of closing within 1% of the HOD.

Introduction 7 Style Lessons We 8217 Ve Learned From The 2015 16 Football Season 1.jpg

One of the fundamental aspects of trading psychology is the perception of risk. Traders often weigh the potential gains against the possibility of losses, and this perception can vary greatly among individuals.

Fear and Greed

Fear and greed are two emotions that dominate the trading arena Pocket Option Affiliate . Fear of missing out (FOMO) can lead to impulsive decisions, while greed can cloud judgment and lead to excessive risk-taking.

Fear and greed are two emotions that dominate the trading arena Pocket Option Affiliate . Fear of missing out (FOMO) can lead to impulsive decisions, while greed can cloud judgment and lead to excessive risk-taking.

Confirmation Bias

Confirmation bias occurs when traders seek out information that confirms their pre-existing beliefs about the market, ignoring contradictory evidence. This can lead to poor decision-making and missed opportunities.

Overconfidence Bias

Overconfidence bias is the tendency to overestimate one’s abilities and underestimate the risks involved in trading. This can lead traders to take on larger positions than they can handle, leading to significant losses.

Loss Aversion

Loss aversion refers to the tendency of traders to prefer avoiding losses over acquiring gains of equal value. This fear of losses can prevent traders from cutting their losses early or taking necessary risks to achieve profitable outcomes.

The Highs and Lows

Trading is often described as an emotional rollercoaster, with exhilarating highs and devastating lows. The thrill of a successful trade can quickly turn into despair with a single wrong move.

Dealing with Emotional Swings

Managing emotions is crucial for success in binary options trading. Techniques such as mindfulness meditation, journaling, and seeking social support can help traders cope with the emotional ups and downs of the market.

Developing a Trading Plan

Having a well-defined trading plan can provide structure and discipline to your trading approach. This plan should outline your goals, risk tolerance, and strategies for entering and exiting trades.

Practicing Discipline

Discipline is essential for maintaining consistency in trading. This means sticking to your trading plan, avoiding impulsive decisions, and accepting losses as part of the trading process.

Seeking Professional Help

For traders struggling with psychological barriers, seeking professional help from a therapist or trading coach can provide valuable support and guidance. These professionals can help address underlying issues and develop coping strategies for dealing with stress and anxiety.

In conclusion, the psychology of binary options trading plays a significant role in shaping traders’ behavior and outcomes. By understanding the psychological factors at play and implementing strategies to overcome barriers, traders can improve their chances of success in this challenging but rewarding endeavor.

- Is binary options trading purely based on luck?

Binary options trading involves both luck and skill. While luck can influence short-term outcomes, long-term success requires a solid understanding of market dynamics and disciplined trading strategies.

2. How can I control my emotions while trading?

Controlling emotions while trading requires self-awareness and practice. Techniques such as mindfulness, deep breathing, and cognitive reframing can help manage stress and prevent impulsive decision-making.

3. What are some common mistakes to avoid in binary options trading? Common mistakes in binary options trading include overtrading, ignoring risk management, and chasing losses. It’s essential to have a clear trading plan and stick to it to avoid these pitfalls.

4. Should I seek professional help for trading-related anxiety?

If trading-related anxiety is significantly impacting your performance and well-being, seeking professional help can be beneficial. A therapist or trading coach can provide support and strategies to manage anxiety and improve trading outcomes.

5. How can I develop a successful trading plan?

Developing a successful trading plan involves setting clear goals, defining your risk tolerance, and selecting appropriate trading strategies. It’s essential to regularly review and adjust your plan based on market conditions and your evolving goals and preferences.