Parents Day

Accepted payment methods

Can you set a stop loss on pocket options? Pocket Option provides risk management tools like Stop Loss and Take Profit orders, helping traders limit potential losses and secure profits automatically.

How much to make $500 a month in dividends? That usually comes in quarterly, semi-annual or annual payments. Shares of public companies that split profits with shareholders by paying cash dividends yield between 2% and 6% a year. With that in mind, putting $250,000 into low-yielding dividend stocks or $83,333 into high-yielding shares will get your $500 a month.

Introduction Parents Day

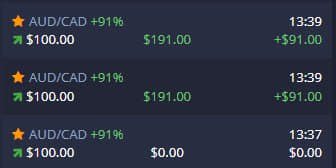

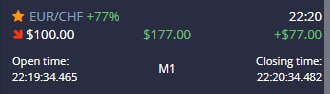

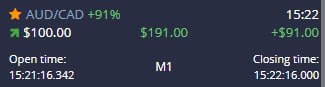

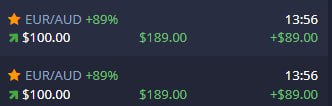

Lean back while MT2Trading places trades according to your rules

An incredible community of Binary Options traders

that help each other to achieve success.

4.3

Overall user rating

Verified by TrustPilotPeople love MT2 because…

- Can actually make profits

- Saves a lot of time & stress

- All-in-one trading platform that offers risk management

- Integrated with MetaTrader & top brokers in the market

We asked our clients to tell their experience

It's been amazing using MT2Trading. I have recommended to so many friends here in Nigeria. The app does what I couldn't do easily and with precision. Thanks to the team.. Looking forward to ur new innovations.😇😇

Winifred Ade

Nigeria

Been a client for over 3 years, MT2 is the best robot to automate Binary Options trades

Marcos Pasin

Brazil

I’ve been trading since 2017 and have experienced many copy-trading platforms as both copy master and copy trader, and none has ever made me feel as “simple and easy to use at reasonable price” as MT2TRADING.

Worawong Pattanawong

Thailand

MT2 has helped to copy trade as I was losing money with account management but now I can make money in forex and shared this opportunity with all my friends, we re enjoying this opportunity. I recommend that to all of u.

Honore Iyak

Rwanda

Life has been calm since I started using mt2trading. there is always a new update. the team always at their game. thanks mt2trading.. God bless you guys. paving ways for others.

Mariantus Adebayo

Nigeria

Very good, fulfills everything it promises and the support is also very effective.

Bruno Damada

Brazil

MT2Trading platform is simply the best software to automate binary signals. The flexibility of the software and the many option it has just gives me the best experience trading binary. Great tool with great features.. Keep it up guys

Theophilus Buckman

Ghana

Very good app. Have been using it for a while now, and im very pleased. Use it for both social trading and for a bit of automation, and it has worked like a charm :)

Hans Fróđi Jensen

Faroe Islands

Earned some serious bucks with this app

Marek Mutwil

Singapore

Amazing trading platform, most of the time I am generating profits without doing any efforts. 10/10 I strongly recommend to everyone !!

Cemani Widodo

Indonesia

This is the best platform to copy trading. The service is Never before ever After. The support response is awesome. I have been using MT2 for 1 year. Worth it.

Ch. Prashanth Reddy

India

I have been using it for a few months now and have gone from 50 to 500 USD in a month, just with the signal service. the application is great recommended +++

Fernando Garavito

Colombia

Have now been with MT2 for just over 5 months. I have been very profitable, more so than with any other strategy or signal service I have used in the last 3 to 4 years. Their support team has been super fast and efficient at resolving any issues

Gerrie Olivier

South Africa

Excellent platform for copy trading, with proper money management and time management, can make a profit every day without sitting in front of your PC. Also, the best place for beginners to make a profit and invest in the market.

Shane Abeyaratne

Sri Lanka

Frequently Asked Questions (FAQ)

01. What is the robot win rate?

Since there are infinite ways to trade automatically with MT2 platform, the robot win rate/effectiveness is totally variable to each user. Your results will depend on the technical indicators you set up on MetaTrader or the signals providers you subscribe to, your general configurations, risk-management parameters and overall strategy.

02. How much money will I make?

As well as the robot win rate/effectiveness, the generated income will be totally variable in each case and up to each user. Our platform allows infinite options regarding the technical indicators used, CopyTrading providers, general configurations, risk-management parameters and overall strategy.

03. What is the minimum investment?

The minimum investment will depend on how many brokers you operate with, and the required minimum deposit for each one.

- IQ Option’s minimum deposit: 10 USD

- Binary.com’s minimum deposit: 5 USD

- Spectre.ai’s minimum deposit: 18 USD

- Alpari’s minimum deposit: 1 USD.

- OptionField’s minimum deposit: 10 USD

- InstaBinary’s minimum deposit: 5 USD

- CLMForex’s minimum deposit: 18 USD

04. Are there risks of my account being blocked?

No. There are absolutely no risks of your account being blocked or banned by using MT2 Platform.

Development teams and legal departments of all our supported brokers have examined our platform and officially approved it.

05. Which brokers does it work with?

Our platforms support 7 of the most reputable Binary Options brokers:

- IQ Option

- Binary.com

- Spectre.ai

- Alpari Fixed Contracts

- OptionField

- InstaForex

- CLMForex

06. What are the accepted payment methods?

We accept credit/debit cards through PayPal and PayOp, Skrill, Neteller, Bitcoin and other major cryptocurrencies through BitPay, PerfectMoney, AdvCash and Payeer.

07. Do I need to leave my pc on all day?

Although our platform application needs to be constantly running on your laptop/PC, if you want it to operate while you are away, there is no need to leave your laptop/PC turned on all day long.

You can hire a VPS (virtual private server) and configure our platform on a remote system!

WARNING: From all of our supported brokers, all accept and support VPS’s but IQ Option. Using a VPS to trade on your IQ Option account could result in a account ban or block.

08. Can I connect any MetaTrader indicator?

You can connect any arrow indicator that output signal to color buffers in MetaTrader platform. You can check the color settings of your indicator to see if the arrow colors appear there!

09. Can I use Martingale strategy?

Yes! You can enable Martingale strategy and select between 6 types different types:

- Martingale “On Next Expiry”

- Martingale “On Next Signal” based on connectors signals

- Martingale “On Next Signal” based on terminal signals

- Anti-Martingale “On Next Expiry”

- Anti-Martingale “On Next Signal” based on connector signals

- Anti-Martingale “On Next Signal” based on terminal signals

10. Is MT2 available for mobile devices?

Yes, you can connect your MT2 platform with your smart-phone & get instant access to your trading account! You’ll be able to monitor your trading performance, historical statistics and start/pause your platform.

Make money by telling

people about MT2

Join our affiliate program and earn passive income by

promoting MT2Trading platform on your website, group,

channel or by recommending it to friends & family.

Start today your free trial!

-no credit card required-

MT2 Software Ltd.

New Horizon Building; Ground Floor;

3 1/2 Miles Philip S.W. Goldson Highway,

Belize

LINKS

GUIDES

- What is MT2Trading?

- Auto Connector

- CopyTrading

- News Filter

- Configuration

- Martingale

- Signal Builder

SUPPORT

- Help

- Documentation

- Terms and conditions

- Frequently asked questions

- Privacy Policy

MT2 Software LTD.

New Horizon Building; Ground Floor;

3 1/2 Miles Philip S.W. Goldson Highway, Belize

Links

Support

- Help

- Documentation

- Terms and conditions

- Frequently asked questions

- Privacy Policy

We use cookies on our website to give you the most relevant experience by remembering your preferences and repeat visits. By clicking “Accept”, you consent to the use of ALL the cookies.

Manage consentPrivacy Overview

This website uses cookies to improve your experience while you navigate through the website. Out of these, the cookies that are categorized as necessary are stored on your browser as they are essential for the working of basic functionalities of the website. We also use third-party cookies that help us analyze and understand how you use this website. These cookies will be stored in your browser only with your consent. You also have the option to opt-out of these cookies. But opting out of some of these cookies may affect your browsing experience.

Always EnabledNecessary cookies are absolutely essential for the website to function properly. This category only includes cookies that ensures basic functionalities and security features of the website. These cookies do not store any personal information.

Non-necessaryAny cookies that may not be particularly necessary for the website to function and is used specifically to collect user personal data via analytics, ads, other embedded contents are termed as non-necessary cookies. It is mandatory to procure user consent prior to running these cookies on your website.