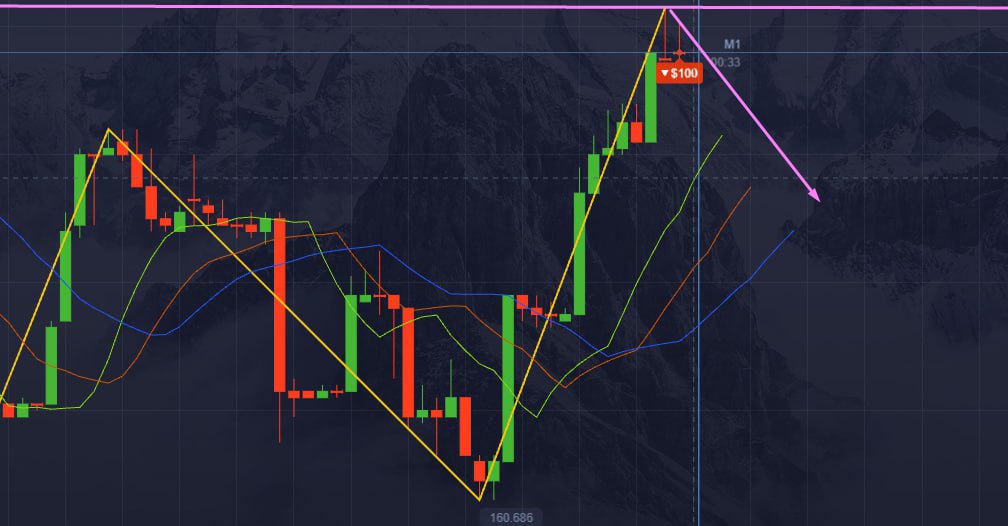

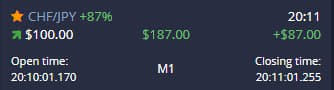

Pocket Option Account Flip

Binary options brokers often require their customers to provide detailed verification documents to comply with Know Your Customer (KYC) regulations, but there are many valid reasons why traders may wish to trade anonymously or without providing personal information . This article will serve as a 101 guide on binary options trading without KYC, explaining how applications work, the key documents they require, and why brokers follow checks Pocket Option Usa . We also list top brokers that offer binary options trading with no KYC verification in 2024.

How much does Pocket Option cost? Pocket Option doesn't charge fees or commissions on withdrawals and deposits. Here's how they make their money: Trader losses. Users who purchase gems and other boosters with cash.

Is Pocket Option legal in the US? Yes, Pocket Option is a legitimate broker. They are regulated by the IFMRRC and comply with anti-money laundering and know-your-customer policies.

Introduction Pocket Option Account Flip

Show Filters

Show Details

Filter Brokers

Show Filters

Show Details

Filter Brokers FCA Regulated Low Deposit Signals Service Islamic Account Cryptocurrency MetaTrader 4 MetaTrader 5 Copy Trading Spread Betting Found 3 Brokers

Quotex

Quotex has been a top binary options broker since 2019, offering over 400 binaries across currencies, commodities, stocks, and crypto. With contracts spanning 5 seconds to 4 hours, short-term traders enjoy flexibility while payouts that exceed 95%, offer high potential returns. Continuously adapting to trader demands, Quotex provides a user-friendly platform for trading binaries.

| Demo Account | Regulated By | MT4 Integration |

|---|---|---|

| Yes | No |

| Min. Deposit | Min. Trade | Leverage |

|---|---|---|

| $10 | $1 | None |

Spectre.ai

Spectre.ai is a binary options trading platform that offers an innovative blockchain-based system and proprietary products with payouts up to 400% . Spectre sources liquidity directly from traders with no middleman, and offers a transparent trading environment with all transactions visible on a verified ledger Pocket Option Withdrawal Gcash . The broker offers contracts on crypto and forex pairs with flexible expiry times and instant payouts on an easy-to-use bespoke platform and mobile app.| Demo Account | Regulated By | MT4 Integration |

|---|---|---|

| Yes | St. Vincent and the Grenadines | No |

| Min. Deposit | Min. Trade | Leverage |

|---|---|---|

| $0 | $1 | 1:40 |

Cryptobo

Cryptobo claims to be the first Bitcoin-based binary options broker, with 1.5 million registered clients and 50,000 trades executed on average per day. Users benefit from 24/7 trading opportunities with up to 91% payouts, alongside no minimum deposit and three-hour withdrawals.

| Demo Account | Regulated By | MT4 Integration |

|---|---|---|

| No | No |

| Min. Deposit | Min. Trade | Leverage |

|---|---|---|

| 0.0000001 BTC | 0.0000001 BTC | None |

Know Your Customer (KYC) Checks Explained

Know Your Customer (KYC) is a requirement in most countries, including the UK. KYC regulations are part of broader Anti Money Laundering (AML) requirements which mean that financial service businesses – including online brokers – must have access to information about their customers.

Upon registration, binary options traders will usually need to fill out a questionnaire to have full access to the services provided by their online broker. Pocket Option, for example, has a 4-step verification process, requiring the customer’s email address, proof of identity, address and bank account verification.

In 2022 alone, the UK’s Financial Conduct Authority (FCA) issued $44 million worth of fines for businesses not working according to KYC and AML laws, illustrating the active role this regulator plays in controlling financial services under its jurisdiction.

However, traders may find that their chosen binary options broker is regulated by a different, offshore agency. As a result, UK traders may be able to trade binaries without submitting the same detailed documentation and personal information. We shed more light on how to trade binary options with no KYC verification later in this article.

Different Jurisdictions

Some countries have tighter KYC laws than others. Checking the country where a binary options broker is based may give an idea about how much information and knowledge they will require when you sign up for a trading account.

Countries With Strict KYC Regulations

- UK

- USA

- Switzerland

- Luxembourg

- South Korea

- Canada

- Japan

Counties With Moderate KYC Regulations

- Austria

- Latvia

- Singapore

- Lichtenstein

- Denmark

- Australia

- Finland

- India

Countries With Loose KYC Regulations

- Barbados

- St. Vincent and the Grenadines

- Belize

Benefits Of Trading Binary Options With No KYC

While tight regulations generally help remove undesirable actors and individuals from a market and make it safer for all, in some cases binary options traders may have perfectly legitimate reasons to avoid strict Know Your Customer requirements.

Some traders simply do not have the required documentation to complete the more stringent checks. If a binary options broker demands a copy of your passport and you do not have one, or if you live in an area where submitting an address check is complicated, then you may not be able to pass a know your client rule.

At the same time, many UK traders are wary of giving out their personal information online, even to binary options brokers that appear to be entirely above board. The last decade has shown that even huge, multinational corporations with tight security are susceptible to hacks, so it is understandable that some traders wish to keep their sensitive data to themselves.

How To Trade Binary Options With No KYC

The first thing for traders to remember when they look for a binary options broker that does not require KYC checks is that they should put their security before anything else. It is worse than pointless trading binary options with an unsafe broker just because they do not require ID verification – in the end you could easily find that you have simply thrown your money away, and have no way of getting it back.

Having said that, there are some trusted binary options brokers and reliable websites which accept traders without KYC checks. These generally fall under two categories:

- Binary options brokers that do not require KYC checks for full accounts

- Binary options brokers that allow users to open partial or demo accounts with no KYC requirements

If the binary options broker requires no KYC checks from any customers, it is likely to be unregulated – at least in any major jurisdiction. As such, you should be cautious, refrain from depositing too much cash initially, and withdraw your profits regularly. Even if the binary options broker is honest and upfront with its customers, the lack of oversight means that if it goes bust, there will be no easy way of getting your money back. This is particularly important because most binary options brokers with no KYC checks run blockchain-based platforms and several high-profile crypto exchanges have failed in recent years.

In cases of binary options brokers such as Quotex and Spectre.ai that allow limited trading on accounts with no KYC, traders should be careful that they fully understand the terms before they sign up. Most of these binary options brokers will only allow unverified traders to sign up for a demo account and make paper trades. But some platforms allow traders to deposit and trade with real funds, but require KYC verification to make a withdrawal via wire transfer.

Alternatives To Trading Binary Options Without KYC

There are a few solutions for traders who wish to bypass KYC checks but can’t find what they’re looking for among binary options brokers.

Different Trading Products

Some forex and other trading brokers allow customers from the UK which imposes KYC checks to trade without following restrictive ID requirements. Examples include Prime XBT. To sign up, traders only need to input their name, email address and set the password, though this is an unregulated broker so the usual warnings apply.

Note, binary options traders who switch may need new trading strategies and more practice, but if you can trade binary options on forex, stocks and commodities already, then this could be a viable option, as there are very few binary options brokers without KYC requirements in the UK.

Cryptos

Cryptocurrency and blockchain were set up partly on the premise that they offer anonymity. Blockchains are essentially a digital database of all transactions. The main advantage of them is that they are decentralised, meaning your trades and transactions are secure and information is not made available publicly.

Bear in mind that regulators have started to come down on crypto markets, and in the UK speculating on cryptocurrencies like XLM and XRP has been heavily curtailed. Additionally, crypto trading platforms and investing software such as Binance are required to comply with KYC laws, so you may need to find old-fashioned methods of buying your cryptocurrency tokens and store them in a cold wallet if you want to avoid these checks.

For transactions to remain anonymous on any blockchain such as Ethereum or Bitcoin, ensure there is no link between your cryptocurrency wallet and other data.

Bottom Line On Binary Options No KYC Trading

KYC is a legal requirement in the UK and many other countries, that all financial services, like online brokers, must follow. However, binary options traders who are unable or unwilling to provide detailed private information may be able to find alternatives based in different jurisdictions and accessed online. These could come in the form of unregulated binary options brokers, forex or other trading brokers that do not require KYC checks, or in the cryptocurrency space.

FAQ

What Information Do I Need To Provide To Binary Options Brokers For KYC Approval?

It is typical for the KYC process to request pictures/copies of a passport or national ID card, a recent utility bill, and a recent bank statement. This is to provide proof of name, date and place of birth, home address, phone number, email address, and source of funds. Note, binary options brokers may have login rules and trading limits in place until KYC approval has been provided.

Are Binary Options Brokers With No KYC Requirements Legit?

Binary options are a legitimate form of online trading, and there are some well-known brokers with laxer KYC requirements and thousands of customers. Scepticism is raised from their high-risk nature, but, as with all trading, the more practice and research you do, the higher your chances of profiting.

Why Are KYC Applications Important For Binary Options Traders?

KYC benefits both traders and brokers. Brokers must follow KYC regulations to avoid non-compliance fines, and traders benefit from the security it offers against their trading account being hacked (as suspicious activity should be spotted).

Is It Illegal To Trade Binary Options Without KYC?

There is not usually any legal burden that falls onto retail traders. You may find a binary options broker that offers unlimited trading without the need for KYC, but it will most likely be flagged (especially if the broker is regulated), and the company will be fined or face other repercussions. The exception to this is if you trade with offshore firms that are not regulated by an agency that requires KYC compliance. Alternatively, some crypto-based binary options platforms offer anonymity when you trade.