Pocket Option Copy Signal

Binary or ‘digital’ options have been around for several decades Pocket Option Bloqueia . Originally, only large financial institutions and the wealthy had access to this type of trading.

Which is better, quotex or Pocket Option? We have rated Quotex (87%) higher than Pocket Option (84%), but the overall rating can't be the only determining factor.

How long does it take for a Pocket Option to pay? In case of using electronic payment methods, the transaction time can vary from seconds to days. In case of using direct bank wire, the transaction time can be from 3 up to 45 business days.

However, the US Securities and Exchange Commission (SEC) allowed binary options trading in 2008. The internet and technology gave the whole world access to binary options.

The demand for binary trades increased rapidly, aș they are simple to understand and easy to access.

Table of Contents

Introduction Pocket Option Copy Signal

- What is Binary Options Trading?

- Options Trading Example

- Types of Binary Options Trading

- Advantages of Binary Options Trading

- Risks of Binary Options Trading

What is Binary Options Trading?

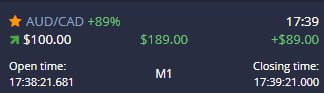

Binary options are financial instruments that allow investors to speculate on whether the price of an asset will go up or down in the future. The trade time (known as time frame) can be as little as 60 seconds, making it possible to trade hundreds of times per day across any global market.

Binary options depend on the outcome of a “yes or no” proposition, hence the name” binary”.

In other words, a binary option is a type of option with a fixed payout in which you predict the outcome from two possible results. If your prediction is correct, you receive the agreed payout. If not, you lose your initial stake, and nothing more. It’s called ‘binary’ because there can be only two outcomes – win or lose.

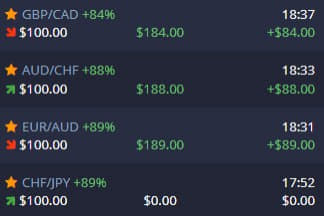

In binary options, the gain or loss on the trade is automatically credited or debited to the trader’s account when the option expires. The payouts usually are ranging between 70% and 90%. These platforms charge high broker fees from 10% to 30%.

Binary options let traders profit from price fluctuations in multiple global markets, which are simple to understand, making them a popular choice for low-skilled traders.

The binary options trader places a Call order when bullish on a stock, index, commodity or currency pair, or a Put order on those instruments when bearish. For a Call order to make money, the market must trade above the strike price at the expiration time. For a Put to make money, the market must trade below the strike price at the expiration time.

Options Trading Example

Let’s say Bitcoin’s price is $6.000, and you think that in 15 minutes from now, the price will be higher than the actual price – that means you place a “Call” trade.

At the end of the 15 minutes, if Bitcoin’s price is higher than the entry price, even with 1 cent, the trade is won.

The same thing happens when you place a “Put” trade – it means that the trader speculates that in 15 minutes from now on, the Bitcoin’s price will be lower than the entry price.

Types of Binary Options Trading

1. Call / Put trades are the simplest in binary options trading. They are the best entry-level option for traders who are new in the world of binary options trading.

2. Touch / No Touch trading allows predictions on whether or not an asset’s price chosen by the trader will be reached before the trade expires. This order type is particularly useful during times of market volatility, or for certain styles of technical analysis.

When trading binary options, risk and reward are known in advance, offering a significant advantage. There are only two outcomes: Win a fixed amount or lose a fixed amount. They’re simple to use, and there’s only one decision to make: Is the underlying asset going up or down?

Classic binary options platforms are prone to fraud and hence banned by regulators in many jurisdictions. Many binary option outlets have been exposed as fraudulent.

But despite the somewhat negative reputation, binary options are legal. The majority of companies operate fairly, but some out there that operate scams, with some unregulated brokers promising quick cash, whilst operating frauds.

Binary options themselves are legitimate and can be a profitable trading instrument when used correctly. However, steer clear of ‘instant money’ promises, brokers that cold call, and celebrity endorsements, plus any claims that you can ‘start trading binary options for free.’

To profitably trade binary options, their pros and cons need to be understood and making sure binary options are the right tool for generating profitable trades, risk tolerance, and capital requirements.

Advantages of Binary Options Trading

The most significant advantages în trading binary options are outlined below.

- Simplicity – By deciding on only one factor, direction, the bet is straightforward. The price can only go up or down. No need to concern with when the trade ends, the expiry time takes care of that.

- Fixed risk – The risk is kept to a minimum with very few trading parameters.

- Trade control – Knowing what is gained or lost before entering the trade, there is greater control from the start.

- Profit potential – The returns in binaries are extremely attractive. Some brokerages promise payouts of up to 90% on a single trade. Binary options can be defined as simple trades with large profit potential.

- Choice – Binary options gift traders the opportunity to trade instruments across virtually all markets.

- Accessibility – Real-time charts are available for every market 24 hours a day.

Risks of Binary Options Trading

While there are plenty of reasons to delve into trading on binary options, there remain several downsides:

- Reduced trading odds with some brokers.

- High broker fees from 10% to 30$.

- Limited trading tools – Most brokers offer advanced charting and analysis capabilities, but trading tools for binary traders are often limited.

- Price of losing – A win percentage of at least 55% to break-even is needed.

- Risk management – Losing capital can happen with ease, and this type of trading could not be suitable for all traders.

Maximize profits by looking for brokers with a competitive and transparent fee structure. A broker offering low minimum deposits is ideal for testing this trading system. Make sure the broker’s platform is easy to use and provides all the charts, patterns, and tools needed to make smart and accurate trade decisions.

For beginners, a Demo account first is a sensible idea. Funded with simulated money, it’s the perfect place to make mistakes and learn before real capital is put on the line. Most binary options Demo accounts require no deposit and are a great way to practice at first.

- Pionex vs Binance 2021 | Trading, Fee, and Bots

- Binance Review 2021 | Everything you need to know

- Different Types of Crypto Wallets

- How To Buy Ethereum? [2021 Edition]