Pocket Option Online Earning

The Profitability Calculator shows you how much you’re making or losing on a trade based on your entry price, the current price, the instrument you’re trading, and your account currency Pocket Option Brasil . It also factors for rollover or swap if your account charges that.

Can you transfer money from one Pocket Option account to another? Yes, via the "deposit" button. You then have the choice between depositing money from your main account or another pocket of yours.

How can I make $100 a day on my phone?

Use this tool for current trades or theoretical trades. Your trading platform shows you the profit or loss of current trades – but what if you want to know the profit on a trade you’re considering but haven’t taken yet?

I was recently working with a student that didn’t understand how lot sizes and pip values affected their profit Pocket Option Strategy Smart Trading With Simon . By using this calculator they were quickly able to see how different variables affected their trade, and they could plan accordingly.Introduction Pocket Option Online Earning

Here’s how to use the calculator to calculate your profits and losses for you.

Account Currency – Choose the currency that your account is denominated in (which would be the currency you deposited into your account). If you don’t know, log into your platform and look at your balance; it will usually say 2,136 EUR or 10,568 USD. The type of currency it lists is the account currency.

Account Leverage – This is how much leverage your broker provides you. If you’re unsure, just leave it as-is; it won’t affect your profit/loss calculation.

Rollover Policy – Some brokers provide better rollover rates than others. Rollover is the amount your account is credited or debited each day based on interest rates and the fees the broker charges for holding a position overnight (past 5 pm EST).

Choose “Regular” if you have a normal account. This will charge you a higher rollover fee and give you a smaller credit. Use this option if you want to see your worst-case scenario profit or loss. Choose “Advanced” if your broker offers good rates. This will charge you less rollover or credit you more rollover than Regular.

Choose “Premium” if you get preferred rates. This will charge the least amount of rollover, or credit you the most rollover.

Islamic Account – If you have an Islamic account, you’re not charged or credited rollover. Select this if that is the case. You can also select this if you’re a day trader and won’t be holding positions overnight. Rollover doesn’t apply to you either.

Side: BUY or SELL – Choose whether you’re buying or shorting the asset.

Instrument – Choose which instrument you’re trading, such as the EUR/USD or an Oil CFD. Click the dropdown and select the instrument, or start typing in the search box to bring it up, then select it.

Amount (contracts or units) – Input the amount or currency or the number of contracts you’re buying. For example if you are buying a currency, input 1,000 for a min lot or 100,000 for a standard lot. For a CFD, input how many contracts you’re purchasing, such as 1 or 2 for a Gold CFD.

Pip Amount – This is how many pips the position is making or losing. It is the difference between the Open Price and the Current Price. You don’t need to do anything with this.

Open Date – Input the date the trade was opened. Leave it alone if the trade is being opened today. This allows for the proper rollover to be calculated, since rollover is credited/debited each day the trade is open (not on weekends; rollover is triple on Wednesdays).

Open Price – The price at which you bought or shorted the asset.

Current Date – Leave this alone if the trade remains open or is a theoretical trade. Uncheck the box if you’re checking the profit/loss of a prior trade. Unchecking the box will allow you to input a prior date when the trade was actually closed. Once again, this allows for an accurate rollover calculation which affects profits.

Current Price – This field is automatically filled on, based on the current price of the asset.

Trading Commissions – This is your commission cost per million (mio) traded. Input the closest commission cost to your own from the dropdown menu.

Commissions are usually charged in the “base currency”, which is the first currency listed in a forex pair (e.g. for the EUR/USD, the EUR is the base currency). If trading a CFD, the commission is usually charged in USD, but check the specifications of the contract with your broker to be sure.

15 per mio = 1.5 per 100K = 0.15 per 10K = 0.015 per 1K

Equity – Choose how much equity you have in the account. This step is not required.

Net Deposit – Choose your deposit amount. This step is not required. Traded Volume – Choose how much volume you trade in a typical month. This step is not required. Below, you’ll see your profit and loss calculation, which includes commissions and rollover. There’s also some other information about the position.

Margin requirement – This is how much capital you need in the account to maintain the position. It is calculated: (Open Price x Amount) / Leverage

Weekend margin requirement – This is how much capital you need in the account to hold the position through a weekend.

Weekend margin can vary from overnight margin, because there is no trading on weekends and thus there’s increased risk the position could move against you. Some brokers increase margin requirements for weekends. Calculated as: typical margin x 3.333

Pip Value – This is how much a pip of movement, for your position size (Amount), is worth. Basically, this is how much you make or lose every time the price moves one pip.

Volume Commission – This is the cost of opening the position, based on the amount you’re trading and your commission cost. This cost is only for the entry. Double it to include a commission for the exit.

Rollover – This is how much your account will be credited or debited due to rollover. If it is a green (positive) number you‘ll receive approximately that amount into your account (though brokers’ rollover rates vary).

If it is a red (negative) number, that’s approximately how much will be taken from your account. Our rollover calculation is a running total depending on how many days the trade is open.

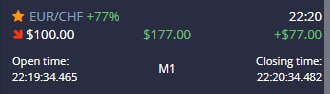

Total P&L – This is the overall profit or loss from the trade. It is the profit or loss from the trade (difference between the open and current price x Pip Value), less commissions, +/- rollover.

Profit Calculator Example – USD Account

Let’s say a trader buys 10,000 USD/JPY at 131.90. The current price is 132.07. Assume the trader has a USD account and a commission of 15 USD per mio ($0.15 per 10K). The calculator can calculate the profit of the trade. Based on the exchange rate at the time, the pip value is 0.76USD.

This pip value is multiplied by how many pips the position is in the money. Our trader is 17 pips onside/in the money.

They purchased 10,000 of the USD/JPY, which incurs a 0.15USD commission.

$12.92 – $0.15 = $12.77

This trader may not incur any rollover if they don’t hold the position overnight. If they do hold overnight, for each night they hold they will receive a small credit into their account since US interest rates are higher than JPY interest rates (subject to change). The rollover amount is added to the profit of the trade.

Profit Calculator Example – AUD Account

Let’s use the same example, but assume the trader has an Australian dollar (AUD) account. This trader still has a 17 pip profit, but the pip value is different for them since they used an AUD account. In the USD/JPY, the position is based on the USD. Our trader is buying 10K USD (first currency in the pair) and so commissions will be based in USD.

The pip value is based on the JPY (second currency in the pair), which requires an AUD/JPY conversion. This produces a pip value of AUD1.10 (at the time of the trade, and subject to change). Therefore, our trader is making 17 x AUD1.10 = AUD18.7 The commission is based in USD, but converted to AUD.

The calculator provides us with a commission cost of AUD 0.22. The profit on the trade is: AUD18.7 – 0.22 = AUD18.48. Since our US and AUD traders took the same position size and are profiting the same number of pips, if we convert the profit of one trader into the currency of the other, they should match up.

If the AUD/USD exchange rate is (and it was at the time of these calculations) 0.6912, we can multiply AUD18.48 by 0.6912 = USD12.77. Our traders made the same amount, just in their own account denominated currency. It’s nice to have an idea of how all this works, but ultimately, you have the trade profitability calculator to help you out if you ever get stuck trying to figure out the profit or loss on a trade.

FAQs

- How to calculate profit on a stock trade?

The profit or loss on a stock trade is the difference between the entry and exit (or current) price, multiplied by the number of shares. Include dividends, and deduct commissions if necessary.

Calculate the profit on a forex trade by taking the difference between the entry and current (or exit) price. Multiply this by the pip value for the position size you are trading. Deduct commissions, and then add or subtract rollover.

Multiply the amount you wagered by the payout percentage to calculate your profit on a binary trade. For example, if you wagered $10 and the payout is 75%, your profit will be $7.50.

A trader’s calculator calculates profits and losses, or really any calculator that helps a trader to trade. There are also other types of calculators such as pip value calculators and position size calculators.

Rollover is either credited or debited to/from the account every day the position is held past 5 pm EST. Rollover is a combination of interest rates and broker fees, and this determines how much you must pay or how much you receive. Note that rollover rates vary by broker.