Pocket Option Payment Failed

Everything you need to trade binary options successfully.Research Pocket Option Qt Demo . Find a broker . Trade.

Which is better, IQ Option or Pocket Option? Is Pocket Option or IQ Option better? Overall we have rated Pocket Option (84%) higher than IQ Option (80%), but there are additional factors to take into consideration.

Are pocket options rigged? Pocket Option is not a trusted broker because it is not regulated by a financial authority with strict standards. We would not open an account for ourselves with them. If you want to stay safe, only sign up with brokers that are overseen by a top-tier and stringent regulator.

For UK investors, trading with binary options is a tax free form of investment with very quick results – minutes rather than months or years. The word binary is used because there are just two possible outcomes – either the trade is successful, and the investor gains a significant return (usually between 75% to 95%) – or the trade is unsuccessful, and the full investment amount is lost.

During 2018 however, European regulators have prohibited the sale or promotion of binary and digital options to retail investors in the EEA Pocket Option Mercado Aberto . This includes the UK . Only professional clients or professional accounts are now permitted to trade binaries with regulated firms . A professional trader must meet 2 of these 3 criteria:- Open at least 10 trades of ‘significant size’ per quarter (brokers define ‘significant’ differently)

- Own a portfolio or trading capital of €500k or more

- Have worked for 2 years in the financial industry, or have experience with complex trading instruments.

Unregulated firms may not adhere to the new ESMA rules, and will continue to accept UK traders. This does increase risk for the trader, and makes finding a trustworthy broker even more important. It is however, possible to find brokers regulated outside of the EU that will accept EU traders, and are still regulated by respected bodies.

So ‘binaries’ (or ‘digital options’) are a high risk form of investment, but that risk is offset by the potential for very high rewards with minimal waiting time. Most brokers are regulated, offering consumers the sort of protection they would expect while using financial instruments of this type. Returns from binary trading are also currently viewed as tax free by HMRC.

Introduction Pocket Option Payment Failed

| Min Deposit | Min Trade | Payout | Bonus | Demo | Regulated | App | Visit |

|---|---|---|---|---|---|---|---|

| $50 | $1 | 92% | 50% Deposit Bonus | Review | » Visit | ||

| $250 | $0.01 | 98% | 20% to 200% Deposit Bonus | Review | » Visit | ||

| $250 | $0.01 | 95% | 20% - 200% Deposit Bonus | Review | » Visit | ||

| Review |

What Are Binary Options?

Binary option meaning – Binary options are a derivative, traded on any asset or market. For example a stock price (Twitter, AstraZeneca etc), indices (FTSE, DAX, Nikkei), commodity value (gold, crude oil) or foreign exchange rate (EUR/USD, GBP/USD). Even cryptocurrencies such as Bitcoin or Ethereum can be traded.

The main difference between more traditional stockbroker trades, and binaries, is the clear identification of risk and reward before the trade is made. An investor knows exactly how much is at risk, and crucially, also knows the exact value of any potential returns. No calculator, formula, or maths degree is needed to work out profit and loss on a binary option.

This structure of the trades is what has led to the terminology of “all or nothing” , or “cash or nothing” being widely used.

The only decision for a trader is if the value of the underlying asset will rise or fall. The degree of the price change is not important. The trader is purely speculating on whether the price will be higher or lower than the current price, at a specific time in the future.

Short term price movement can be triggered by news stories or headlines, quarterly statistics, buyout rumours or even global security fears.

Trading binary options offers a Yes/No proposition. Although there are variations on the High/Low option, this type of investment will always have a black and white, Yes/No, binary outcome. Where trades can be closed, redeemed or sold mid-trade, payouts have absolute figures of 0 and 100 and prices move between as the market dictates – until closure.

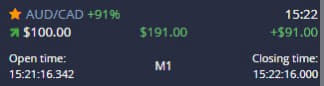

Expiry Times

Every binary option is offered with an expiry time. This is the point at which the trade will end. So the price at expiry is the one that will decide whether an option has won or lost (“in the money”, or “out of the money” in binary jargon). These expiry times can vary from just 30 seconds or 1 minute, (known as ‘turbos’), to a full day (‘end of day’), to even longer in some circumstances – rolling up to a full year.

Generally however, a binary option is used for short term trading – usually under 30 minutes (5 minutes are the most popular). Longer term expiries – and the element of fixed risk – does make them useful tools for hedging or diversifying other holdings.

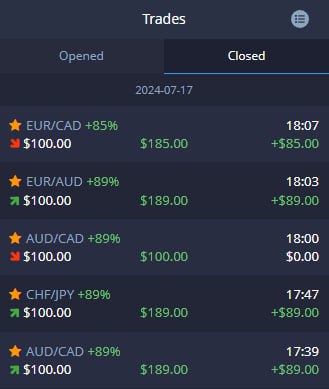

Payouts change dependant on the asset and the expiry time. Differences can be significant so traders looking to use binary options long term, need to shop around to find the best payout for the asset class (or classes) they intend to trade.

Video Tutorials – Binary Trading Explained

When watching video tutorials, ensure you know the source or creator of the video. Brokers may produce promo videos that appear to show profits being made easily.

Trading on a demo account is often a better to way to ‘see how it works’ than being led astray by some expensive marketing.

Risk WarningThe Financial Services provided by brokers on these pages carry a high level of risk, and can result in loss of funds. Only trade with money you can afford to lose.

Legitimate Investment

Although binary trading is in a period of growth, it remains a relatively unknown product. Over time, this is likely to change. As digital options (as they are also known) offer a very simple fiscal arrangement. They are a legitimate way to play the financial markets.

Binaries offer a clear trading choice, but they are also high risk / high reward. There is however, no leveraged exposure with a binary trade, so the risk and reward ratio is also simple to manage.

The structure gives binary trading it’s strength. It is a tool that can be used to hedge other investments, or can be operated as an investment vehicle in it’s own right. There are a wealth of trading strategies, and each caters for a specific investment need.

Are Binary Options Safe?

Binary options suffer from a poor reputation. This is basically a result of dishonest and irresponsible marketing and cyber crime, more than an issue with the product itself. With tighter regulation, and a better understanding by the wider public, these options can – and will – move into the financial mainstream. Which was where they originally developed.

While FCA regulated agents and businesses may still have their flaws and faults, they are not fraudsters. The angry emails we receive focus entirely on unregulated brokers promising “easy money”, or a route to “get rich quick”. Read our section on avoiding scam brokers below.

Advantages Of Binary Trading

Many of the advantages of using binaries are related or linked. Here we list some of the benefits to using this form of investment – not just for the retail investor, but also to the market makers or brokers:

Risk management

Managing risk when trading binary options is clear cut. The amount of the trade is the full amount that is at risk. This clarifies the risk not only for the trader, but for the broker too. Their pricing model reflects the accurate knowledge of their liability.

Trading Fees And Spreads

The certainty of risk provides a solid foundation for brokers to work within and manage. This leads to low trading feed, tighter spreads and higher payouts. To protect themselves further, they may use a liquidity provider or hedge their own positions. The expensive broker costs of clearing houses becomes unnecessary.

Leverage

Leverage, or gearing, is not generally available with binary trading. This benefits the broker again, as it means all trades must be funded in full. In other words, no trader can default on a trade. With leverage, if things go wrong, there is a real risk of the broker not being paid. This is a big difference vs spot forex or spread betting.

Trader Choice

Layers of complexity can be added to the standard fixed payout option. From a ladder option, to boundary trades or more advanced ‘nesting’ of options to create ‘strangles’ etc – binaries can be used in a huge variety of ways.

A binary trade offers the greatest level of flexibility. They even provide a mechanism to speculate on a market remaining flat, arbitrage, or to take a view on the trade volume of the underlying asset.

Robots and Auto Trading

Auto trading robots (‘bots’) often rely on signals and algorithms triggered by price graphs. Again, these robots attract many of the undesirable operators, and the automatic nature of the trades increasing risk further. New traders should be especially careful. A large amount of ‘due diligence’ is required when trying to find the right robot service.

An alternative approach is for traders to build their own robots using their own entry points. A growing number of brokers now offer traders the ability to put their own trading robot or program together, using simple tools. These hacks allow combinations of technical analysis settings, such as moving averages, Bollinger bands or RSI / MFI patterns, that then open trades when those criteria are met. It has made binary options ‘pro’ robots available to everyone.