Pocket Option Queen

On this site, we will show you our best 6 Binary Options Strategies . They have hit rates of over 70% . You can easily use it in every timeframe like 60 seconds or higher expiry time . Also, it is possible to use the Martingale strategy to improve your results . The best one is called the “False Breakout Strategy” . It works on every asset and in every timeframe . Learn to trade profitably in a few moments Pocket Option Trading . Look at the picture below for the first impressions.

What is the minimum deposit for Pocket Option? To start Real trading you have to make an investment in your account (Minimum investment amount is $5). Please first top up the balance to start Real Trading. Your document was uploaded. Please allow some time for our specialists to review it.

How does Pocket make money? Displaying sponsored content is one way that Pocket can earn revenue and sustain itself while offering Pocket for free. By upgrading to Pocket Premium, you are helping Pocket's efforts more directly, and therefore you won't see any sponsored posts in Pocket or Pocket Hits newsletters.

If you only trade this style of trading, it is possible to make a lot of money. In the next chapters, we will provide you with more information to win against the market!

Find the best Binary Options strategies hereIntroduction Pocket Option Queen

- False Breakout Strategy

- Follow the Trend Strategy

- The Rainbow Strategy

- The Candlestick Strategy

- The Money Flow Index Strategy

- The Turtle Strategy

1. False Breakout Strategy

The False Breakout strategy is the most accurate way to trade the markets. Trading breakouts do not work very well. We have tested it many times in the past (We will show you the reason why it does not work well below). After a breakout, the market comes back most of the time.

All you have to do: is search for a level (high/low or support/resistance) and wait for the market to break the level. If the market comes back, you can go short (put) and long (call).

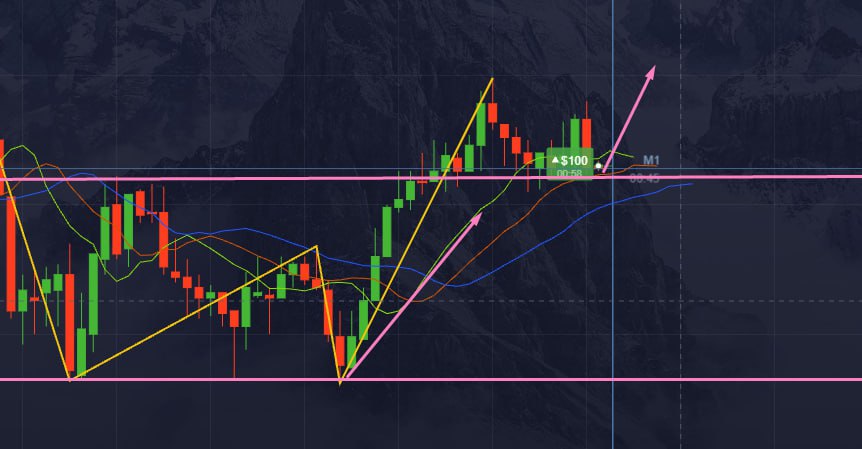

False Breakout: The market breaks a high/low or support/resistance and comes back to the level, and stays under/upper the level. Support/resistance is more than one high/low in a row. You can use this method in any timeframe and with any asset/market. It is universal. See the picture below!

Theoretic methodSee our video about this binary strategy:

By loading the video, you agree to YouTube’s privacy policy.

Learn more

Always unblock YouTube

(Risk warning: Your capital can be at risk)

Why does this Binary Options Strategy work so well?

For this question, it is important to have more knowledge. At highs and lows are a lot of stop-losses from other traders in the market. Professional traders use this knowledge to get high liquidity for their own positions. They quit or open a trade where high liquidity is. In most cases, they will fake this breakout, or the market will turn because of closed positions.

There are a lot of traders who will trade such breakouts. Algorithms are programmed and triggered to make them lose money.

Facts:

- Stop-losses are triggered with a breakout

- A lot of stop-losses mean higher liquidity

- This knowledge is used to open or close big positions

- The market will turn around in most cases

- Sometimes it is a short turnaround, and sometimes, the trend will change completely

Which levels are the best for trading?

New and fresh highs and lows are the best levels for this best strategy for binary trading! With several highs in a row, it is more likely that the market will break through this level. Search for big new and fresh highs. For the best results, the level should be created in the current day. See the picture below.

Different levels for your entriesFurthermore, the best levels got the V-Form. We will show you the picture below. The V-Form is seen clearly by a lot of other traders in the market. They put their stop-losses on these levels. Also, it is possible to trade the V-form as support and resistance. We rather wait for the false breakout of the V-Form. It works with a high hit rate and you can easily make money by trading Binary Options.

(Risk warning: Your capital can be at risk)

The best level V-FormWhen to choose your entry? – For dummies

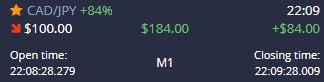

Risky traders open a position directly in the opposite of the breakout. In our opinion, there is a better way to get good results. In the picture below, we will show you the exact entries. Select the level in the markets. If the market passes the level back, you can open the trade. It is just as simple as it sounds. Sometimes you will need 2-3 trades to make a profit. That is why we double the investment amount if we lose a trade.

Additional information: You can wait for a candle close below/upper the breakout level to get a better confirmation

Which timeframe can I use for this Binary Options Strategy?

You can use any timeframe for this best strategy for binary options. The time does not matter for your analysis. Only the price of the asset matters. No professional trader cares about time. You will see that the small timeframes are more difficult to trade because you have to pay more attention to the market. You have to react much faster than in higher timeframes. In conclusion, only the price of the asset matters.

Exact trade entrySee another video with an exact example of the fake breakout:

By loading the video, you agree to YouTube’s privacy policy.

Learn more

Always unblock YouTube

Best binary broker: (Risk warning: Trading is risky)Pocket Option - Trade with high profits

1 2 3 4 5 5.0 / 5Pocket Option - Trade with high profits

- Accepts international clients

- High payouts 95%+

- Professional platform

- Fast deposits

- Social Trading

- Free bonuses

2. Follow the trend strategy

Trend follow StrategyThis is one of the best binary trading strategies for beginners. This trend follow strategy can be applied everywhere regardless of trading amount or market. First, you must study the trading graph and pattern of lines. You must have observed that they usually go in a zigzag manner. This might seem like an easy job, but it requires practice.

First, it is better to get familiar with trading graphs and their trend on demo trading apps before trading your money in a real-time market.

Once you learn to read the pattern, it will be easy to predict whether the asset’s price will go high or low. However, this best binary strategy isn’t very reliable for short trades. To apply this best binary option strategy, you must study the chart and see the movement of lines.

If the line is going up, the prices are increasing and vice-versa. If the line is horizontally straight, then find some other option to trade your money.

It is essential to have practical knowledge, practice on the demo trading sites and get a clear-cut idea.

(Risk warning: Your capital can be at risk)

3. The rainbow strategy

The use of this most accurate binary options strategy must be done in combination with the news strategy. First, you must know the nature of the market you are trading in. Then, after knowing about the ongoing trend, you can start using this strategy. This is a strong strategy that increases the chances of right predictions and winning.

This best binary trading strategy uses basic signals to make reliable predictions about the asset’s price.

The rainbow strategy is a pattern that includes the usage of various averages in actions with varied periods. Each of these periods is identified with a different color.

The moving averages are used to recognize the price changes. Moving averages with many periods react slowly to price changes, and moving averages with few periods react quickly.

If you observe a strong movement in the asset chart, the moving averages are most likely to move from a slow to a fast direction in real-time trends.

News Trading Rainbow StrategyThe average that moves the fastest will be placed closest to the asset price, the second closest will be the second fastest, and the third closest to the price will be the third-fastest moving average, and so on.

When you observe that the numerous moving averages are placed in the pattern as discussed above, you can say a durable movement in price in a determined direction. Therefore, when you encounter such a pattern and trend, trade your money right away as this is a favorable time.

You can choose how many averages you would like to use. Most good traders use three moving averages.

If the moving averages are positioned so that the shortest line is above the medium moving average and the longest is below the medium line or moving average. You must trade on the asset prices falling.

It depends on you to determine the number of moving averages in a period. Therefore, it is recommended to use a duplex of periods you used previously in each moving average.

This change in the number of periods used in different moving averages will give you reliable ratios, which will, in turn, provide you with precise signals.

For beginners, it is advised to use the ratio of 5, 10, 15, 20, and so on.

Steps that you can take to achieve the right order:

- Trade right away – once you achieve a desired or familiar pattern after the last moving average gets positioned, it is the right time to invest your money.

- Practice patience – if you want to test the best strategy for binary options and avoid going all-in, then wait for a period. This way, you can check if the signal helped you in making the right prediction or not.

- Wait for 2-3 periods – this step gives you a sense of security, especially when you are trading a large amount of money and don’t want to risk relying on just one period. You wait for two to three periods or even more as per your wish.

- Take your time to understand the trend of the asset chart and then make a move. However, wait no more than three periods. After three periods, the market may start to change, and new trends might set in.

(Risk warning: Your capital can be at risk)

4. The candlestick strategy

Candlestick StrategySteve Nison introduced the binary candlestick formation strategy in one of his books in the year 1991. A good trader must know how to read asset charts.

Once you understand its patterns and movements, it will be easy for you to predict the next move of the asset in the charts. For example, there is a pattern formation in the asset charts called the candlestick formation. The patterns formed by the lines going up and down appear like candlesticks.

The top line is the highest price, called the mountain, and the bottom line is the lowest, called the valley. There is no one specific formation in this strategy, but there are a few that you must learn to identify and read to trade better.

To apply this binary option trading strategy, you must observe the chart and pattern of prices for a while. You will notice some repeated pattern formation. Then you can use your knowledge and experience to predict whether the line will go up or fall.

(Risk warning: Your capital can be at risk)

5. The Money Flow Index strategy

Money Flow Index StrategyThis binary options best strategy is beneficial if you are planning to play it quickly, let’s say 5 minutes. Yes, this strategy works that quickly. It is fast and effective.

Being a trader of binary options trading, you must be aware that the trading market is not random in the short term. One more benefit of this strategy is that it saves you a good amount of time. If you play in 5 minutes, you can make more trades per day.

However, such short-term binary option trading strategies are required risk management and technical analysis. You must know that the stock prices don’t change in 5 minutes, regardless of whether the company is working well or badly in the market. So, the money flow index strategy is time-saving but also includes lots of risks.

The only thing that changes the asset’s price in a short period is the demand and the supply. These two factors determine whether the asset’s price will go up or fall in a concise period.

To master this strategy and make money every 5 minutes with Binary Options, you must learn technical analysis. This will help you in understanding whether the other traders are selling or buying. Once you understand this, it will be effortless to use the MFI strategy with the money flow index indicator.

MFI index indicator – the indicator tells you the ratio of the asset sold to the number of the asset purchased. The value is generally between 0-100.

Let us now understand how the money flow index indicator works:

- The number 0 – indicates that many active traders plan on selling the asset.

- The number 50 – indicates that an equal number of active traders want to purchase and sell the asset.

- The number 100 – indicates that all the traders active on the platform want to purchase the asset.

Now that you understand the relationship between the ratio of the MFI indicator and the traders planning on buying or selling the asset, it will be easy for you to choose one option and secure your money. In addition, you can easily estimate the asset price movement after understanding the demand and the supply.

In simpler words, if the number of traders buying an asset is much greater than the number of traders selling the same asset. There will be fewer traders to force the price of assets upwards. As a result, the demand and price will both go down.

In the same way, if the number of traders selling an asset is greater than the number of traders buying it, the supply will diminish, and prices will increase.

Mentioned below are the ways you can use the MFL index for your next accurate prediction:

- If the money flow index is more than 80. It means that many traders buy the asset, and the prices may fall.

- If the money flow index is less than 20. It means that many traders sell the asset, and the prices are likely to rise.

This best strategy to trade binary options works best for a short period. Traders usually use this strategy to play 5 minutes bets. In the long run, it is tough to predict the process through this strategy as it goes to extremes. So, avoid using this strategy for your long-term trades.

(Risk warning: Your capital can be at risk)

6. The Turtle Strategy

Turtle Trading StrategyThis is one of the best binary option strategy among traders. As the name suggests, this strategy uses the movement of asset prices in the last twenty days. Then use this data to predict the next hit; it might be a high or low. This strategy provides you with two signals:

- The buy signal – when the current price movement is higher than the bars/lines of the last 20 days.

- The sell signal – when the current price movement is lower than the bars/lines of the past 20 days.

This is one of the best binary option trading strategy and it can be used easily by beginners. However, the outcome of the turtle strategy has been mixed. Trading strategies help a trader in identifying signals; none of them promises to be 100% accurate.

What is a Binary Options strategy?

A Binary Options strategy is a trading method used to predict the price movement of a specific underlying asset and determine whether to buy or sell a binary option.

The Binary Options strategy should follow strict rules of your trading plan. A strategy can be adjusted to any timeframe, market or trading platform which offers binary trading. Without a Binary Options strategy you trade blind in the market and your profits and losses are random generated.

Why do you need a Binary Options strategy?

Binary Options Strategies can be different methods to trade the market. First of all, a Binary Options Strategy does not have to be difficult. It is possible to make money with simple ideas and methods. Therefore it is important to use strict rules for trading the market. The most common mistake is not keeping to your own rules! In addition, a good strategy reduces emotional and irrational trading.

Most traders lose their money because they trade without a proven method and strategy. Advanced traders know how the market work, and they practice their own methods a lot. You have to learn and get a higher knowledge of the market. From our experience, it is not easy to learn to trade successfully in a short time horizon. In the following article, we will give you strict rules for trading the markets and we will show you how the strategies work easily and successfully.

Reasons to use a Binary Options trading strategy :

- Implementing actions without proper planning or strategies is subject to failure. Therefore, it is crucial to make a strategy before trading your money on any platform.

- It is real money you are dealing with. To be a successful trader, you must know the place you are putting your money into.

- Never treat trade as mere gambling if you strive to be a good trader. Do not rely on guesswork. This way, you will only lose your money.

- Using strategies gives you strong signals about the movement of asset prices. However, you can only use the situation to make a huge profit if you understand the trend and predict correctly.

- It saves you from making impulsive, emotional decisions.

- Once you develop the best strategy for binary option that works for you, you can master and modify it to make a long-term profit.

- Using money management strategies to decide how much money you are going to invest in trading can save you from irresponsibly losing your money. Since greed and guilt can easily manipulate you into taking spontaneous actions.

Fundamentals of a successful Binary Options trading strategy

Before stepping onto the field, you must know two basic parameters of binary option trading strategies – the trade amount and the signal. Let us understand these two parameters in detail:

#1 The signal

A signal is basically a movement in the market or an indication of whether the prices will rise or fall. It is more like an instinct after observing the trend going on around you. Signal helps you identify the next step more. Clearly, it helps you in predicting whether the prices will go high or fall.

There are certain ways by which you can identify a signal. Following are some ways:

Trading is related to business and the market. So, to be good at trading, you must have a decent knowledge of the share or stock market, industry news, and information provided to the public by the CEO. All this can help you predict whether the resources’ price will go up or down.

This is a method where you keep the market news aside and look closely at the trading graph. It is a more centralized approach. You carefully read the graph and analyze events of the past to predict the future.

It is complicated but more reliable. You don’t have to go all-in; there are many demo trading apps available online where you can practice and enhance your predicting skills. Once your brain gets used to the trading pattern, it will be easy to understand the trend of prices going up or down.